The UK has been entering a phase of relative growth underperformance.

A stronger global backdrop is benefiting the UK, prompting us to revise up 2017 GDP growth this week.

But the fundamentals driving domestic demand continue to look weak, particularly household real income.

We hence expect weaker consumption to slow UK growth relative to its trading partners this year.

We expect a shift to sub-trend growth this year will dissuade the BoE from raising rates.

This part of the forecast is the most uncertain. The UK saving rate had already looked low on the basis of historical UK experience and international comparisons. But the further decline from 6.1% to 3.3% during 2016 raises a question of sustainability.

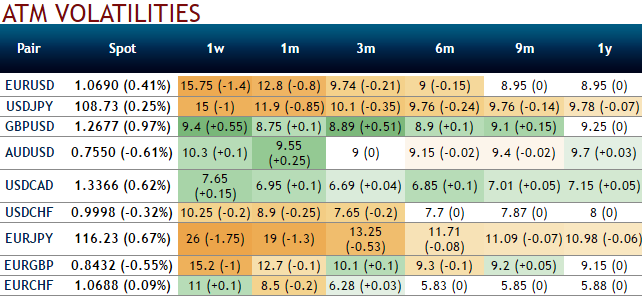

Please be noted that the risk reversals, for now, have taken adverse directions from last 1 year’s hedging sentiments that were bidding for upside risks.

While spiking IVs towards 9% for 1-3m tenors (for GBPUSD) 12.7% and 10% for the same tenors (for EURGBP) and, this volatile OTC market operations are due to the fact Eurozone elections are lined up signify hedging arrangements for upside risks over the period of time.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?