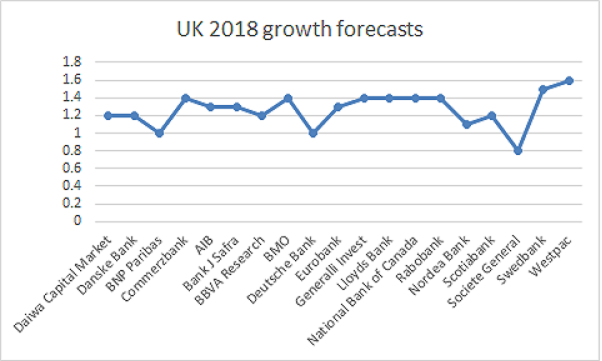

The United Kingdom’s economic growth is expected to hover around 1.3 percent during the course of 2018, owing to the downward pressure created by the ongoing uncertainties over the UK-EU Brexit negotiations that have weighed on the consumer as well as business spending.

While, the UK economy has slowed and is likely to continue on this trajectory until next year, the global counterparts have performed otherwise, which has led to a better export performance, albeit at a slower-than-expected pace.

The Brexit developments have created a significant amount of uncertainty for businesses regarding the future nature of regulation, trade and migration policy between the UK and the EU. Out of the major regions in the UK, London and South East will continue to outperform other areas in terms of regional growth, while the North West and South West are likely to step slightly backward.

Meanwhile, according to a recent report from the EY, the British government has recognized the challenges throttling the UK economy has has come up with an Industrial Strategy for the country, in which it seeks to provide a framework for long-term business decision-making and so offset some of the uncertainties related to the nature of the UK economy after Brexit.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm