The IHS Markit/CIPS UK Services PMI fell to 53.8 in November 2017 from a six-month high of 55.6 in the previous month and below market expectations of 55. Business activity and volumes of new work grew at a softer pace while the rate of job creation was unchanged from October’s seven-month low.

Whereas manufacturing and construction PMIs have managed to produce upbeat numbers, Manufacturing PMI rose to 58.2 in November of 2017 from an upwardly revised 56.6 in October, beating market expectations of 56.5, while constructions prints at 53.1 against consensus at 51.2 and previous 50.8.

Key findings:

Business activity growth slows from October’s six-month high

Sharp and accelerated rise in prices charged by service providers

Job creation remains subdued in November

These are the leading fundamental indicators to signify the economic health and signal how quickly businesses respond to market circumstances, and purchasing managers clutch perhaps the most current and relevant insight into the company's view of the economy.

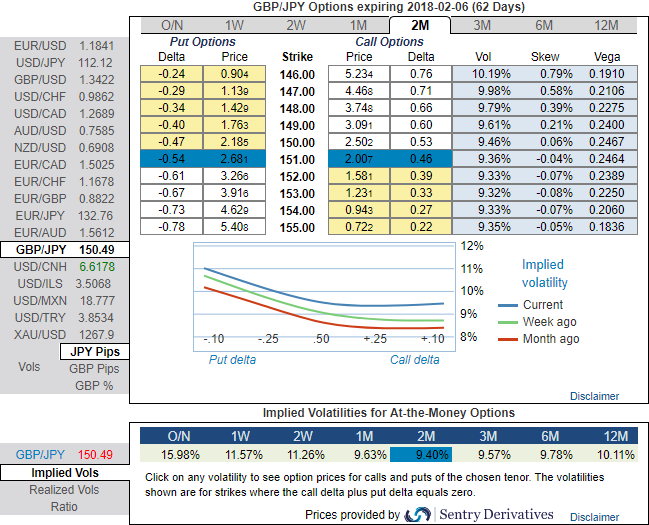

Please be noted that the above nutshell indicates the hedging sentiments still prevail for bearish risks and hence, bid for OTM put strikes upto 146 levels.

To substantiate this stance, 2.5% OTM puts of these tenors are trading at 7.5% more premium than the current IVs of 2m expiries which seems to be justifiable contemplating the major trend of this pair and above stated driving forces.

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing -137 (which is highly bearish), while hourly JPY spot index was at 85 (which is bullish) while articulating (at 06:25 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis