The sterling has been able to gain conspicuously in the recent times and continued the same momentum especially yesterday following the publication of the August inflation data. GBPUSD surged above the 1.3300 mark, while EURGBP momentarily eased below the 0.9000. UK CPI managed to produce upbeat numbers, actual at 2.9% versus consensus of 2.8% and previous flash at 2.6%.

The higher inflation is usually bad for a currency. The rapid erosion of domestic purchasing power is a negative signal for the purchasing power of the currency on the FX market.

However, the reverse applies if the central bank responsible for the currency provides a rate advantage with disproportionally high rate hikes that actually overcompensate for the inflation effect. It would seem that the market assumes that this constellation applies in case of the higher UK inflation. That may come as a surprise as the BoE has been rather hesitant as far as rate hikes are concerned over the past few months. Everything all told the impression dominates that the BoE does not react very actively when it comes to higher inflation but accepts it as an unavoidable side effect of the Brexit related GBP weakness.

While yesterday’s UK labour market figures left recent trends largely intact. The unemployment rate resumed its drift lower, dipping to 4.3%, a new post-crisis low, coming in a notch below consensus but (Consensus and previous: 4.4%). Such an unemployment rate – matching the lows seen since the 1970s – has historically indicated a tight labour market. So far, the response from earnings growth remains relatively muted, however. Overall average weekly pay (including bonuses) was unchanged at a 2.1% annual pace and regular pay – arguably a stickier metric – was also unchanged at 2.1% y/y compared with last month’s report.

More reassuringly for income growth prospects, however, employment picked up further. The numbers employed as of the May ‑ July quarter were 181k higher than in the preceding 3 months, accelerating from 125k in the previous reporting period. Still with the average number of hours worked per person seen falling by 0.1% over the quarter, the unemployment rate perhaps underestimates the amount of slack in the UK economy.

Nevertheless, with the unemployment rate moving down to 4.3% - much sooner than the Bank of England envisaged - and below the MPC’s estimate of the ‘equilibrium’ unemployment rate (4.5%), the pressure on the BoE to reassess their views on the labour market will continue to build. As inflation rises further, workers may yet become more assertive in their wage demands to resist the depletion of their purchasing power. A more rapid pace of wage growth would raise concerns for some Bank of England policymakers that higher inflation is becoming embedded in expectations, warranting a tighter policy stance.

As a result, we continue to expect today’s announcement from the Bank to evidence that only two members of the MPC voted for an immediate hike in interest rates with the others unlikely to be persuaded to join them at the current juncture.

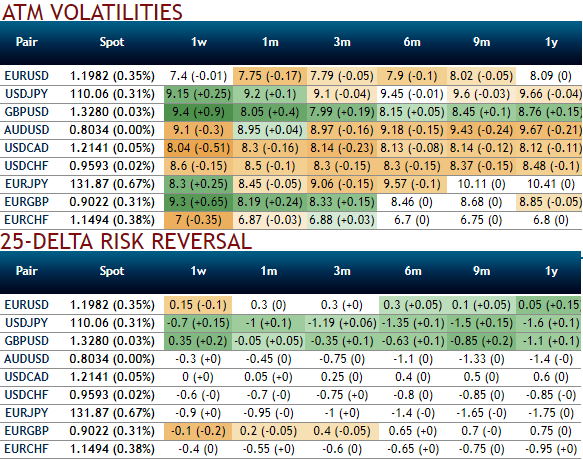

Please be noted that the hedging activities of GBP have been mounting higher, IVs have been progressively rising higher but still on the lower side. The sell-off in the cable skew is exaggerated compared to ATM volatility since the risk remains asymmetric on the downside, the tail risk is mispriced.

While risk reversals have slightly shifted into positive flashes but bearish risks have prevailed on a broader perspective. Hedging sentiments of this pair have turned towards upside risks.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says