We stated in our earlier posts USDTRY has been creeping ever closer to the 6.00 mark through holiday season.

But the Turkish lira rallied sharply yesterday on multiple supportive developments, the key reasons being:

1) Risk sentiment rebounded around emerging markets as tension between the US and Iran appeared to cool down.

2) Risk perceptions surrounding Turkey especially benefitted as President Tayyip Erdogan concluded positive meetings with Russian President Putin and offered to play an ambassadorial role in US-Iran dialogue. This makes it less likely that Turkey's own disputes with the US will be the focus of markets in the near-term.

3) Finally, Turkish Treasury and Finance Minister Berat Albayrak informed the media that the economy had grown very strongly in Q4, in the 5% region. This raised hopes about the economic outlook.

If Albayrak's guidance proves correct -- there is no guarantee: his year-end CPI guidance for 2019 was off by a whopping 4pp -- this would imply around 1.8%q/q increase in GDP for Q4. Q3 was an especially weak 0.4%q/q; this strong Q4 increase would be coming after a year of very depressed economic conditions -- therefore, a strong number in Q4 alone would not imply smooth sailing for the quarters ahead.

The lira is a volatile currency: after a fortnight of negative geo-political and CPI developments, which led to a scary jump in USDTRY from 5.75 to 5.97, we can expect a sharp correction when better news returns -- however, the trend still looks weak.

We maintain a cautious stance as interest rates are being cut even while inflation is accelerating and the real interest rate is about to turn negative. It is likely to get a support at 5.7979 levels. To what extent this is the result of low liquidity and to what extent it is the future ‘trend’ will be clear soon after market participants return from holiday.

We have long held the view that USDTRY would rise sharply during the next EM risk off episode – the reason for such a view is the asymmetric reaction function of the central bank, which can only cut rates but not hike them; this alone is a sufficient condition for the lira to weaken significantly in the medium-term.

Hedging Strategy:

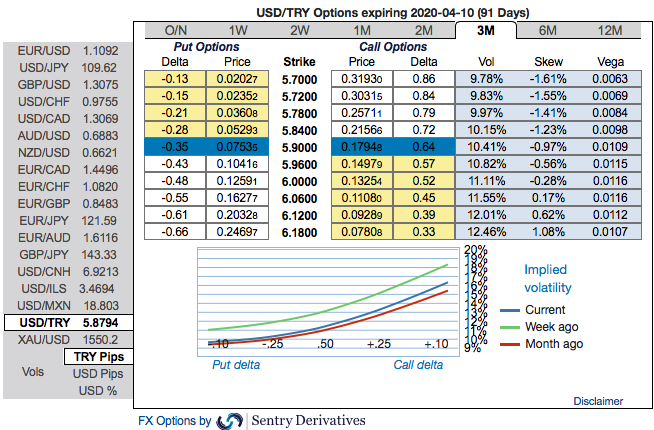

On hedging grounds, capitalizing on prevailing price dips, deploy 2m USDTRY debit call spreads with a view to arresting momentary downside risks and upside risks in the major trend. At spot reference: 5.8795 level, initiated 2m 5.50/6.24 call spreads at net debit. One achieve hedging objective as the deep in the money call option with a very strong delta will move in tandem with the underlying spikes.

It seems that hedgers of TRY are positioned for the upside risks on the above fundamental factors. The positive skewness 2m IVs are indicating upside risks, bids for OTM call strikes upto 5.98 levels indicates bias for bullish risks (refer above chart).

IVs of this underlying pair is also on the higher side, trending highest among the G20 FX space. Call options with a higher IVs cost more, because, increasing IV is conducive for the option holder, just for an intuition that the higher likelihood of the market ‘swinging’ in holder’s favour. Courtesy: Sentry & Commerzbank

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential