Yesterday’s US inflation data disappointed. Both the overall rate and the core rate came in below analysts’ expectations. Is inflation pressure not going to materialize? As a result, shall we not see rapid USD-positive rate hikes? Let’s not get too excited.

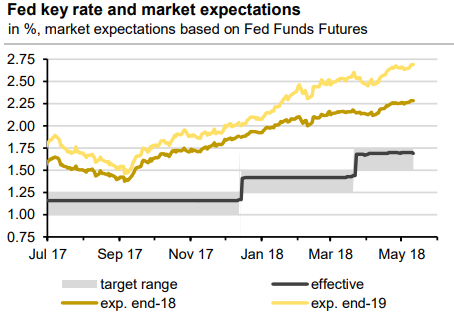

a) The Fed expectations did not suffer as a result of yesterday’s data (refer 1st chart).

b) If one carefully smooths the (seasonally adjusted) inflation data one can see that the (core) inflation trend remains very close to the 2% target (2nd chart).

The Fed does not provide for an overshooting of inflation – with the exception of individual FOMC members.

Contemplating these factors, we explore the factors driving the decline in Treasury holdings at large commercial banks. Rising recession tail risk motivates hedging against a sharp rise in term premium and advocate below interest rate trading strategy.

Use OTM 3s/10s/30s flies to monetize richer term premium in a rally.

Though the base case remains for above-trend growth and firming inflation, rising recession risks highlight the tails to a sharp shift in the outlook.

Weighted butterflies are a good replication of term premium, which tends to richen as the Fed cuts rates. Sell OTM 1Yx10Y receiver swaptions versus a weighted amount of 1Yx3Y and 1Yx30Y.

Sell $100mn notional of a 1Yx10Y 22-delta receiver (notification 4/29/19, maturity 5/1/29, strike @ 2.537%, premium 69.6c) versus buying $172mn notional of a 1Yx3Y 25-delta receiver (notification 4/29/19, maturity 5/1/22, strike @ 2.620%, premium 28.0c) and $12.4mn notional of a 1Yx30Y 25-delta receiver (notification 4/29/19, maturity 5/1/49, strike @ 2.582%,premium 175c). This trade is constructed to be premium neutral at inception. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards -76 levels (which is bearish) while articulating (at 12:00 GMT).

For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary