A fog of uncertainty reigns. Those expecting a shake-up by a maverick Trump administration on various policy fronts have been disappointed. The likelihood of huge deficit-financed fiscal stimuli is fading, while many are wondering if the US strikes on Syria herald a reversion to a traditional foreign policy agenda in Washington. Expectations of US-Russia rapprochement have correspondingly sunk.

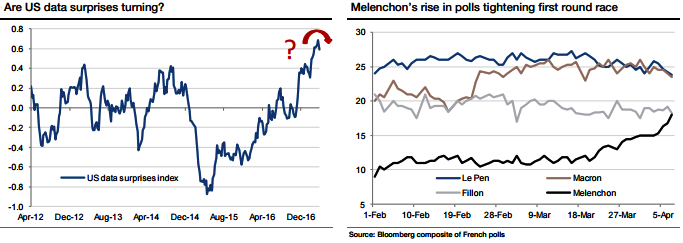

The SPX Index has meandered fitfully lower in the past month, while US bond yields have slipped to the low of the 5-month range. This has led to the curious phenomenon of yen outperforming G10 currencies in a low vol macro environment. The weak US payrolls headline last week was juxtaposed against a new low in the unemployment rate. Meanwhile, elevated positive US data surprises elicit nervousness about a potential mean reversion (refer above chart).

Across the Atlantic, the French presidential election appears to be tightening as Melenchon rises in the polls. Although the polls still show consistently that Le Pen is unlikely to win the election, there is growing uncertainty about who might qualify to face her in the runoff vote. A surprise result in the April 23 vote would splash volatility onto the market (refer above chart).

All this make for a difficult market buffeted by manifold factors in a swirl of white noise. Gleaming through the fog, it seems to us that the key fundamental points are receding US fiscal stimulus expectations amid a (very) gradual ECB creep towards policy normalization. These suggest to us that the euro should do well in time.

This week’s data schedule is unlikely to clear up the fog. Fed Chair Yellen will make a public appearance at the start of the week, and she might try to push back against the market fading the chances of two additional Fed hikes this year. The Bank of Canada is widely expected to stand pat on policy.

Furthermore, the CPI inflation data from the UK, China, Euro area and US will be in focus.

OTC updates:

On-going euro turbulence: The main risks events are now in Europe:

Greek bond repayments due to ECB (April 20), G20 FM/CB Gov meeting (April 21-22), World Bank/IMF Meetings (April 21-23), US gov’t funding runs out (April 28), European Council special meeting (April 29), French Presidential election (April 23 & May 7), Federal Budget 2017/18 (May 9) and G7 Finance Ministers meeting (May 11-13). Other Central Banks: NBH (April 25), BoJ and Riksbank (April 27), FOMC (May 3), Norges Bank (May 4), BoE (May 11), and immigration tensions) and in the US (Jackson Hole, presidential election): this should prop up volatility in EURUSD.

The list of key market events for this week includes:

Apr 11: Sweden CPI, Germany ZEW survey, and UK CPI & RPI.

Apr 12: China CPI, UK employment report, and Bank of Canada meeting.

Apr 13: Australia employment report, France CPI, Germany CPI, US PPI, and US UMich consumer survey. Apr 14: US retail sales, and US CPI.

As the delta risk reversals of euro crosses (except EURGBP) have again shown in bearish interests as the progressive increase in negative numbers signify the traction for hedging sentiments for further downside risks in both short and long term.

Both EURUSD and EURGBP are approaching uptrend support lines from the Dec-Jan lows.

EURUSD 1.0560 and EURGBP 0.8445 are the key near-term technical levels to watch according to our technical analysts. We still favor buying into euro dips.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings