Next week we have a couple of central banks lined up for the data events, Fed, BoE, SNB, BoJ and Norges Bank scheduled for their respective monetary policy meetings. For now, though, USD remains under pressure with EUR and GBP benefitting.

While the Sentiment in the geopolitical surface, remains optimistic through further constructive comments with regards to the US-China trade relations, President Trump seems to be open to an interim deal – seeing US equities close to all-time highs and bonds yields extend higher and build on their recent reversal.

Last month, USDJPY once surged above 109 level, but fell sharply since then toward 105 because of President Trump’s announcement on August 1stthat the US would impose 10% tariffs on $300 billion worth of imports from China from September 1st, and the US Treasury's labelling of China as a currency manipulator on August 5th. JPY outperformed as a typical safe-haven currency and became the strongest currency among majors during the past month and JPY appreciated more than 3% in trade-weighted terms. Since Trump indicated in May that the tariff rate on $200 billion of Chinese imports could be increased from 10% to 25%, the JPY NEER has risen 8%, continuing to be pushed by up developments related to severe US trade policy.

We could now foresee USDJPY’s both bullish and bearish scenarios contemplating the above factors, few are listed as below:

Bearish USDJPY scenarios, see 105 if:

1) The trade tensions between the US and China/Mexico intensify and global investors’ risk aversion heightens significantly,

2) The markets further price in a possibility of Fed’s rate cut and 3) the US starts vehemently criticizing Japan’s trade surplus against the US.

Bullish USDJPY scenarios, see 112 if:

1) The outlook of the US and global economies recovers and risk sentiments firm along with a spike in UST yields,

2) The momentum in JPY selling flows related to outward portfolio investments and FDI strengthens.

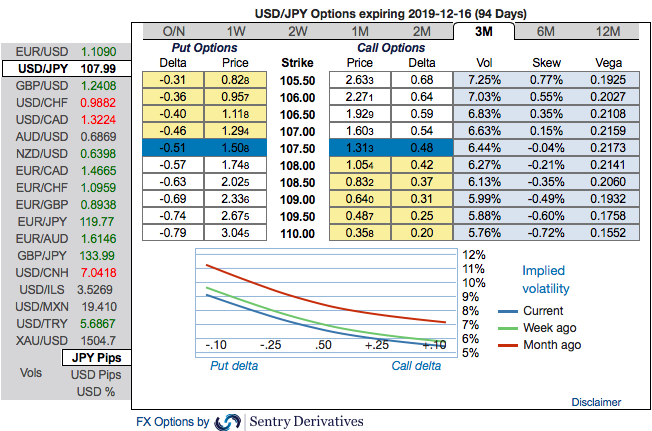

USDJPY OTC update and options strategy as follows:

Please be noted that the positively skewed IVs of 3m tenors are signifying the hedging interests for the bearish risks. We see bids for OTM strikes up to 105.50 levels. This indicates hedgers’ interests in OTM put strikes, overall, put holders are on the upper hand (refer 1stnutshell).

While negative risk reversal numbers of USDJPY across all tenors are also substantiating downside risks (2ndnutshell).

OTC positions of noteworthy size in the forex options market can stimulate the underlying forex spot rate. The spot may trend around OTM put strikes as the holders of the options will aggressively hedge the underlying delta.

Hence, at spot reference of USDJPY: 107.996 levels, we advocate buying a 2M/2w 109.732/105.50 put spread ahead of Fed and BoJ monetary policies (vols 6.78 vs 6.45 choice), wherein short leg is likely to function if the underlying spot FX keeps spiking, we would like to maintain the ITM long leg with the diagonal tenors on hedging grounds. The lower/shrinking implied volatility is good for options writer and increasing realized volatility is good for the bearish trend. Courtesy: JPM, Sentry & Saxo

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close