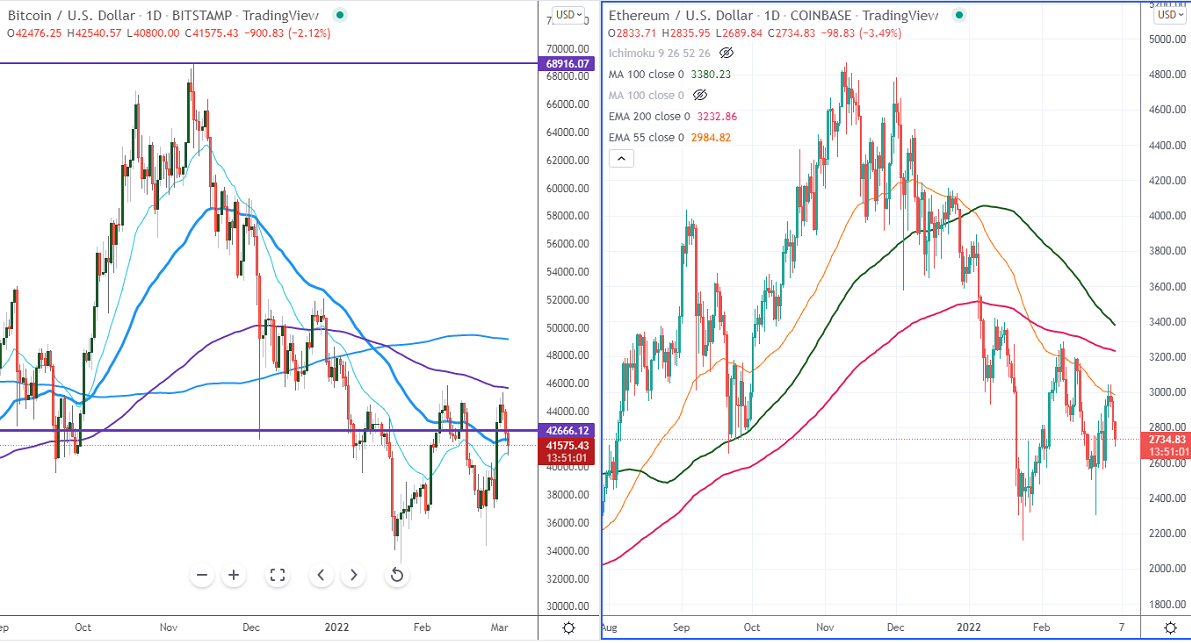

Bitcoin (BTCUSD)-

BTCUSD has once again declined after a jump above $45000. The escalation of geopolitical tension between Russia and Ukraine has decreased demand for riskier assets like stocks and Bitcoin. Markets eye Russia and Ukraine peace talks for further direction. It hits an intraday low of $40800 and is currently trading around $41566.

Bear case-

Levels to watch- $39875. Any convincing break below will drag the Bitcoin to the next level of $37000/$34000. Significant demand zones are $28000. A breach below that level will pull the BTC to $24900.

Bull case-

Primary supply zone -$46000. The breach above confirms minor bullishness. A jump to the next level is $50000/$52000.

Secondary barrier- $55000. Any violation above that barrier targets $60000/$69000.

CCI (50) and Woodies (CCI) hold above zero line in the daily chart.

It is good to buy on dips around $38000 with SL around $34000 for TP of $50000.

Ethereum (ETHUSD)-

ETHUSD continues to trade weak for the third consecutive day. It hits a low of $2689 at the time of writing and is currently trading around $2735.

Bear case-

Levels to watch- $2582. Any close below will drag the ETH to near-term support of $2500/$2300/$2150. Major demand zones are $1700. A breach below $1700 targets $1500/$1288.

Bull case-

Primary - Barrier- $3245 (200-day EMA). The jump above will mark the beginning of an intraday bullish trend. Surge past will push the prices higher till $3325/$3573 (200-day MA).

Secondary barrier- $4000. Breach that barrier targets $4150/$4500/$4784.

It is good to buy on dips around $2500 with SL around $2150 for TP of $3550.