Today’s euro area economic data flow kicked off with a couple of rare upside surprises, starting with the first estimate of French GDP in Q4. The figures showed an increase of 0.3%Q/Q, unchanged from Q3 and 0.1ppt above the market consensus and the rate of growth foreseen by the Bank of France. The interminably tedious EU-UK divorce continues.

Overall, we like to activate bearish EURUSD exposure and uphold shorts in EURCHF upon disappointing Euro area growth;

Account losses on medium-term option short in USDSEK, we argued that the big dollar turn was not yet imminent.

Nevertheless, the base case for 2019 did envisage a handover from the US to Euro area growth and mean-reversion in undervalued European FX like SEK. We had consequently added a medium-term put spread in USDSEK but structured it as a 1-1.5x to lower the cost as we lacked conviction that the trade was yet poised to work.

Euro area developments this week have been uniformly euro bearish with PMIs making near 5-year lows. The ECB changes its risk assessment on growth to the downside and the subsequently released German IFO survey also disappointed, with the expectations component signaling GDP growth of only 0.7% pace.

Given recent surveys, downside risks to Euro area growth and hence EURUSD remain and hence we recommend:

1) Taking losses on our medium-term USDSEK shorts and

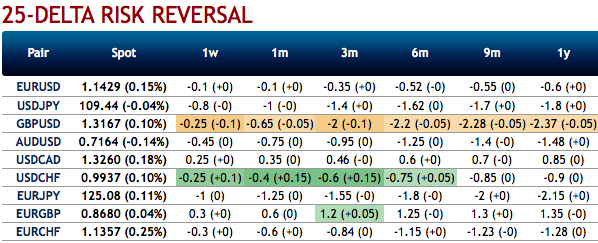

2) Please be noted that bearish neutral risk reversals of EURUSD that indicates the bearish risk in the major trend remains intact, which in turn appeals for activating outright short EURUSD exposure. EURUSD shorts are initiated through a 3m risk reversal to express the view that upside in EURUSD will be capped and also to benefit from risk reversals that are still near the upper end of their 6-month range. In addition, we maintain exposure to EURCHF on the expectation that soft growth will cap upside vs. CHF as well.

Buy 3m 1.1320 EURUSD put; sell 1.16 EURUSD call for net cost of 11bp. Spot ref: 1.14 levels, while simultaneously maintain shorts in EURCHF at 1.1244 with a stop at 1.1469. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 67 levels (which is bullish), while hourly USD spot index was at -44 (bearish) and CHF is -93 (bearish) while articulating (at 10:31 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand