The resolution of uncertainty after last week's referendum opens the door for a relief rally in the short term, but medium term concerns remain; stay MW TRY in the GBI-EM Model Portfolio. The Turkish referendum last weekend was in line with our expectations. The package of constitutional amendments was approved by a weak “yes” (51.4% approval vs 48.6% reject, according to the latest available data from unofficial results).

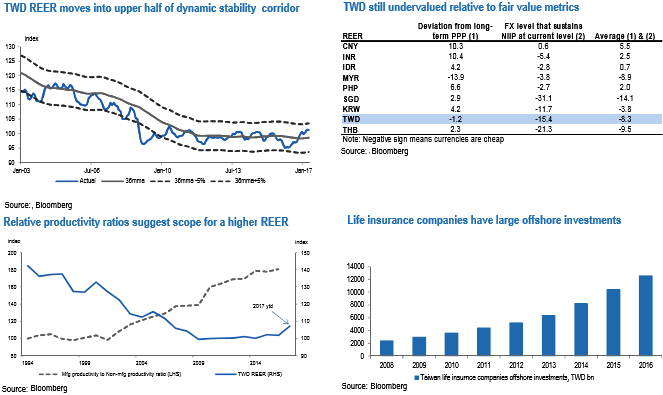

Despite TWD’s outperformance (+6% in spot terms and close to 4% in NEER terms year to date), the currency is still undervalued based on our preferred metrics (refer above figure). The ratio of productivity in the manufacturing to nonmanufacturing sectors is also supportive of higher levels of the REER (refer above figure).

FX markets: For well over a decade, Taiwan’s REER has traded in the lower half of the so-called ‘dynamic stability corridor’ (description of the corridor below, refer above figure).

Insurance companies to potentially adjust hedges on offshore investments another potential source of support for the TWD could come from the hedging behavior of local life insurance companies.

It was reported at the end of last week that the financial regulator in Taiwan had asked local insurers to adjust their FX hedging to reduce the impact of the firmer TWD. The allocation towards offshore investments has risen rapidly over the past decade (refer above figure).

At the end of 2016, offshore investments stood at just below USD400bn, of which around 70% is believed to be hedged.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch