Owning USD calls/CHF puts or USDCHF risk reversals as long USD plays:

Unwind long EURCHF outright and rotate into long USDCHF via a risk reversal, which in conjunction with a pre-existing spot long in USDJPY, positions the portfolio for an ongoing improvement in the US economy.

Rotate long EURCHF into long USDCHF via risk reversal; keep EURUSD call spread, the much-awaited ECB meeting was modestly dovish and with it, Draghi was able to deliver euro weakening alongside a QE “taper” announcement for the second time in a year.

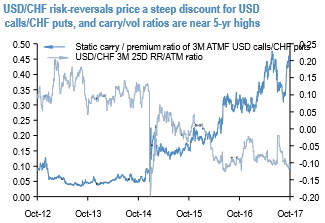

It is stated that USDCHF is one of the only two USD pairs (the other being USDJPY) where owning USD calls has been profitable on a delta-hedged basis since they earn smile theta along a risk-reversal that is bid for USD puts to reflect a premium for a 2015 franc de-peg-like SNB tail event.

In addition, long USDCHF directionally is a positive carry proposition, hence risk-reversals without delta-hedges lean long USD while earning both time decay and forward points.

The RV edge is that risk reversals are depressed via-a-vis ATM vols, which are themselves historically cheap relative to carry in forwards (refer above chart).

A 15’Dec17 (post-December FOMC) 1.01 / 0.98 risk-reversal costs 15bp premium (spot ref. 1.0008), has a very decent spot-to-strike distance ratio of the call and put legs of 1:2.5 and suffers negligible bleed till the final two weeks of its life.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges