The brisk spike in inflation probably rules out new cuts by the central bank in Sweden. After four years mainly spent below 1%, the Swedish CPIF bounced sharply to 1.5% at the beginning of the year, taking a step towards the 2% inflation target. The Riksbank made clear that policy needs to continue to be expansionary to safeguard the rising trend in prices to prevent an excessively fast SEK appreciation.

But with the main rate already at -50bp (at only a step from the implicit floor set in Switzerland at -75bp) and inflation expected to stabilise around 2% next year, new cuts are probably ruled out by the board.

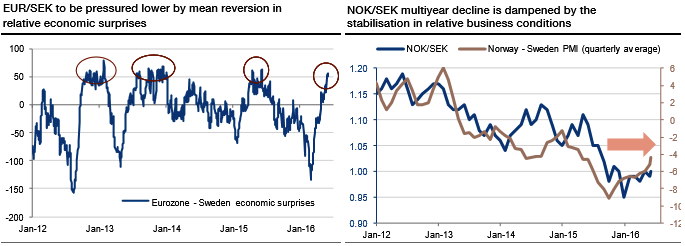

Relative economic factors surprise to pressure EURSEK. With its 4.2% y/y Q1 GDP growth largely beating the European average, Sweden does not have serious competitors among developed countries.

However, the FX market has to deal with a set of negative economic surprises in Sweden whereas the euro area benefited from a positive trend.

It turns out the surprise differential is just reaching its historical peak above 50 points (see graph), with past patterns suggesting a mean reversion lower sooner or later. This should be a key factor pressuring the EURSEK towards 9.5 levels again.

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons