The sterling has been the outperformer among G10 space this week in reaction to the below news, consolidating by as much as 2% in trade-weighted terms and the TWI is now just a whisker away from its post-Brexit high. Market focus has been on recent polls which if realized, would provide a strong mandate for the Government’s Brexit approach and would also remove any risks that hard-line Eurosceptic Conservative MPs could unduly influence May’s Brexit negotiations going forward, thus reducing the tail risk of a very hard Brexit.

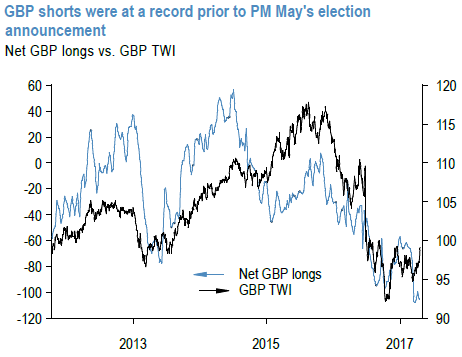

That the news came at a time that GBP shorts were a near record only helped to exacerbate the market move (refer above chart).

UK PM May surprised markets this week by calling for early elections on June 8th, a step that was subsequently voted for by MPs. O relevance to markets has been recent polls which show the Tories well ahead of Labour (refer above chart), which could translate into a majority of 100-110 seats for the Conservatives, up from 12 currently.

Looking ahead, while recent political developments on balance are positive, we are still moderately bearish on GBP over the medium-term. Even though tail risks have diminished, risks to growth still remain (especially relative to other countries which is more relevant for FX valuations).

Our base case continues to be that of a ‘hard’ Brexit (defined as a loss of single market access with prioritization of immigration) and the near-term outlook for growth is unchanged with further slowing expected.

Moreover, the historical relationship between price and positioning in chart 6 indicates that bulk of the GBP shorts initiated this year have been unwound, leaving positioning somewhat cleaner. But we have to take some reassurance, as will investors, that an early vote increases the scope for a transitional period that delays and slows the economic impact of Brexit and thus wait for more clarity on the longer term growth ramifications to reassess.

More relevant for the trade structure in question, the EUR call/ GBP put spread recommended is nearly worth zero so has the limited additional downside and could also benefit from a modest bounce in EUR if our base case in the French elections is realized.

Hold a 2m 0.8575-0.8950 EURGBP call spread. Paid 62bp March 17, marked at 5bp.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise