Usually, option transactions are entered into as a hedge against an unfavourable probable future event.

Foreign exchange options (also known as FX or currency options) are contracts where the buyer has the right, but not the obligation, to exchange currency on a certain future date at the exchange rate and in the amount fixed at the time of entering into transaction, while it is vice versa for the seller.

The combination of buy and sell transactions allows to reduce or do away with premium payments and restricts exchange fluctuations to a specified band.

We explore the potential of trading live (non-delta hedged) FX options based on a well-known and broadly used FX cash trading technical indicator: stochastic oscillator index.

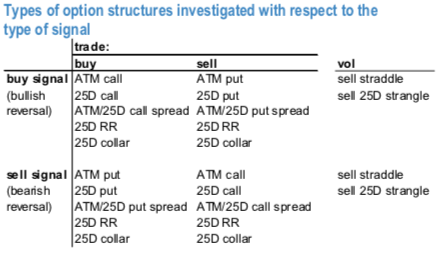

The noticeable thing is that early signs of slowing or reversals in trend could easily be figured out by the stochastic indicator, consequently one can capitalize on such indications via rich universe of directional FX option structures (refer above table).

“Buy” (“sell”) reversals are signalled when the indicator is below 40 (above 60) and is exhibiting higher lows (lower highs). Option trades (non-delta hedged) are entered on the following trading day and held to maturity.

The back-testing (conducted meticulously on G10 USD pairs as one basket and EM pairs as the other basket 2005-present) shows that by using stochastic oscillator reversal points to time trade entry into short-tenor directional option structures, long- term cumulative returns can be boosted by more than 100bps per year (refer 1stchart).

Notably, a sizable portion of the observed returns comes from fading momentum of an existing trend. This makes selling put options on “buy” signals and selling call options on “sell” signals along with owning risk reversals on "buy" and selling them on "sell" signals two favorable expressions that utilize stochastic oscillator (refer 2ndchart).

In the G10 space, most recently stochastic oscillators indicated:

1) Bullish reversal for USDCAD on Aug 2, AUDUSD and EURUSD on Jul 20, NZDUSD on Jul 16 and GBPUSD on Jun 29 – best expressed via long 1M risk reversals or short 1M ATM puts.

2) Bearish reversal for USDNOK on Jul 27, USDCAD on Jul 20, USDCHF on Jul 16, USDJPY on Jul 3 and USDCHF on Jun 29 – best expressed via short 1M risk reversals or short 1M ATM calls. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly BTC spot index is inching towards 44 levels (which is bullish), while hourly USD spot index was at -72 (bearish) while articulating (at 08:37 GMT). For more details on the index, please refer below weblink:

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand