The Turkish lira has staged a notable recovery in the past month. In our view, this has been driven largely by a turnaround in the risk appetite for EM assets as markets shrugged off 'Trumpflation' worries. The central bank has also maintained a high, double-digit effective interest rate in the overnight money market, which has helped.

Fundamental developments in the economy, though, do not appear to be any rosier than a quarter ago: manufacturing is failing to lift-off, fixed investment is down sharply on uncertainty as one might expect, and the current-account deficit is widening again as the oil price is firmer and tourism revenue smaller.

Still, one component of the economy which policymakers had assumed to be relatively resilient is household consumption – household consumption was up nearly 3% q/q just the quarter before the coup attempt.

Turkey and Russia have periodically discussed the use of their respective local currencies in bilateral trade and tourism settlements. Local media reported in Turkey yesterday that CBT could be close to making an announcement to the effect that it would accept ruble repayment from exporters and tourism operators, who would otherwise repay export credit to the Eximbank in US dollars.

At the same time a major Russian owned bank in Turkey is preparing to enable Russian tourists to use their local currency seamlessly in Turkey. Such measures attempt to remove that component of US dollar demand from the banking system, which plays an intermediation role in currency exchange -- this is a 'technical' adjustment, which will eliminate certain spreads of course, but the market is efficient enough that we do not anticipate any noticeable impact on USDTRY behaviour.

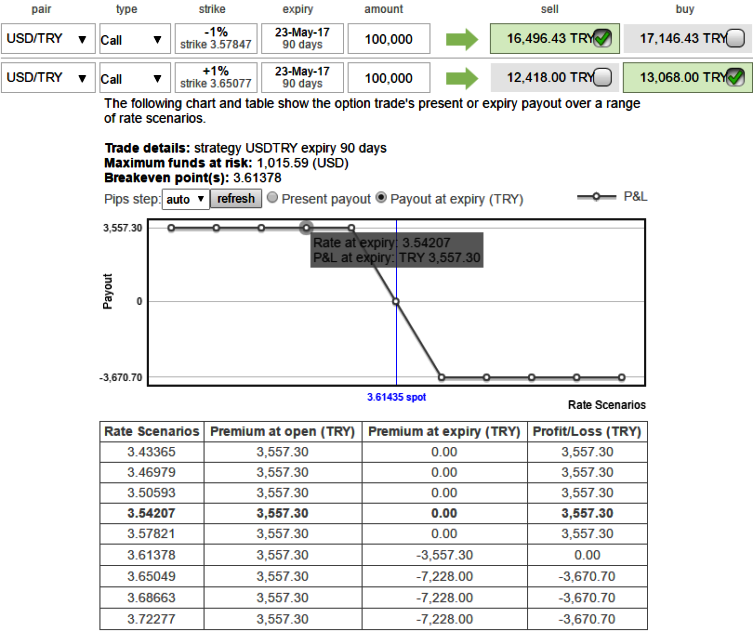

Option Strategy:

For now, contemplating bullish rout in long run amid short term slumps in USDTRY, we advocate 1m3m USDRUB 1x1 diagonal credit call spread with conviction (3.5640, 3.62), at spot ref: 3.6150 the positions could be entered either at net credit or at reduced debit.

Execution: Keeping the above fundamental factors in mind, it is advisable to go long in 3M (strike at 3.5640) OTM 0.36 delta call while writing 1m ITM call (strike at 3.5640) with positive theta and delta closer to zero (both sides use European style options), this credit call spread option trading strategy is recommended when USDTRY spot FX price is anticipated to drop moderately in the near term and spikes up in long term.

Please be noted that the IVs chosen in the diagram is just for demonstration purpose, one should use accurate tenors as stated above.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election