The Brexit debate in the House of Commons enters its third round today. However, any potential progress – should it be made at all – will only be made out of view of the public debate spectacle. According to media reports some Ministers fear such a crushing defeat that the government would become unsustainable and are urging Prime Minister Theresa May to postpone the vote. May on the other hand seems to continue to hope for the impossible. As the report by the Attorney General published yesterday confirmed, the concerns of many MPs that the UK may be permanently tied to the EU should the Ireland backstop come into force. May is allegedly considering to offer that the House of Commons would need to give their consent before the backstops comes into force. While it is still questionable whether this concession is sufficient to guarantee a majority for the Brexit deal, it is highly unlikely in my view that the EU will grant the House of Commons what essentially amounts to a right to veto on the deal.

In other words, chaos still reigns. Interestingly enough this drama is hardly reflected at all in the current GBP exchange rates, which remained in a fairly narrow range over the past few days. The current market sentiment is more notably reflected in developments on the options market.

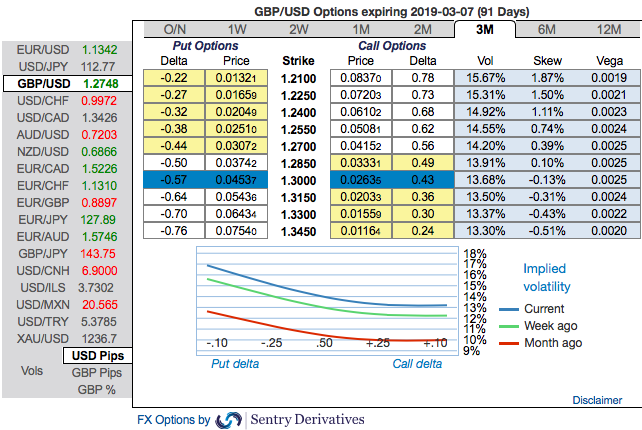

All the above considerable driving forces appear to be factored in GBP OTC option markets:

The uncertainty on where things are heading is creating surprisingly stable exchange rates at present but has caused implied volatility to rise back into the area seen during the chaos of the referendum in 2016. Interestingly enough the risk reversals, which illustrate whether hedging against an up-or-down move of the underlying exchange rate is more expensive, have remained relatively stable at significantly lower levels. That means: a strong move within the next three months is seen as being more likely, but it is much less clear in which direction this move is going to go. It remains more expensive to hedge against strong GBP depreciation, which means that an orderly Brexit in whatever shape is still seen as being more likely. However, the risk of things going wrong is high and as a result, we regard any GBP appreciation with much scepticism. At least until Tuesday, but probably well beyond then.

While positively skewed GBPUSD implied volatilities of 3m tenors still signal bearish hedging sentiments. To substantiate this downside risk sentiment, risk reversals have also been in negative territory despite some minor positive bids in the short-run.

We reiterate that the sterling should not suffer like before, but, one should not disregard Fed’s hiking cycle on the other hand. The market has always ignored the fact that all the current BoE interest rate moves are due to a favourable result of the Brexit process.

Both the speculators and hedgers of GBPUSD are advised to capitalize on the abrupt price rallies for bearish risks and bidding theta shorts in short run (1m IVs) and 3m risks reversals to optimally utilize delta longs.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards 73 levels (which is bullish), and hourly USD spot index has bearish index is creeping at -34 (bearish) while articulating (at 12:46 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025