GBP is the second worst-performing currency over the past two weeks as evidence cumulates of a broad-based loss in economic momentum(the TWI has lost 3%to 1% below the 6m average). The economy was a support for GBP through H2’16 as growth accelerated rather than slowed following the Brexit vote, helped by the easing in financial conditions.

But with growth on course to slow by more than half from the 2.8% recorded in Q4’16 as consumers feel the pinch from inflation and business capex remains weak, GBP is being undermined by a pronounced deterioration in interest rate support.

The deterioration in the UK data cycle could not have been more poorly timed for GBP as

1) It contrasts with acceleration in global growth, and

2) The Brexit process will soon begin in earnest as the UK government is close to securing parliamentary assent for Article 50 (the House of Lords attached two amendments to the Brexit Bill but the Commons is expected to reject these). It should become apparent fairly soon during the formal exit negotiations which follow that the UK is headed towards a harder Brexit outside the single market as Europe is not willing to compromise the EU’s principle freedoms while the UK will not compromise on a desire to control migration. A possible second Scottish referendum can be added to GBP’s Brexit woes (the SNP conference is March 17-18).

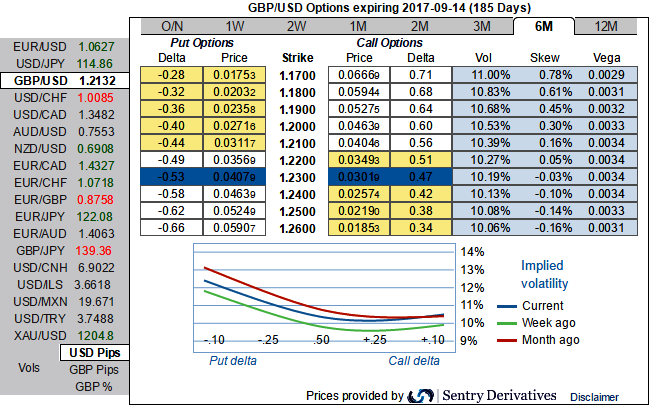

All these fundamental driving forces of GBPUSD are factored in OTC FX markets.

The negative delta risk reversal numbers are bidding for downside risks, while IV slews are also substantiating this stance as the hedgers' interests are stretched towards OTM put strikes.

While risk reversals of 6m tenors also indicate the high degree of bearish risks, this would imply that the puts are relatively costlier than the call options, while 6m IV skews are the evidence of the hedgers’ interests of OTM put bids.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?