Looking at GBP against a UK data surprise index, the British currency has not paid much attention to the improvement in UK data since June, weighed by other factors including Brexit. As such, any rally in response to strong data is likely to be relatively short-lived, with the resumption of Brexit discussions on Thursday to guide sentiment.

Yes, among G10 FX universe, the attention of the likelihood of a ‘no deal’ issue is keeping Brexit risks front and centre, and has taken a toll on the pound remarkably: GBPUSD has shed 2.2% MTD after the near 3% decline since early June, GBPUSD 1Y ATM vol has risen, gained 1.2vol pt since July and 1Y 25D risk-reversals have broadened to levels last seen early last year. We discuss hedging breaks below.

The loudness of ‘no deal’ Brexit likelihood has intensified in the recent past, following International Trade Secretary Liam Fox’s pegging the odds of such a scenario at 60% in an interview. It is reckoned that the consequences of a no deal outcome are too fraught for it to be a serious policy consideration, however, continued media coverage of the issue is keeping Brexit risks front and centre of investors’ radar.

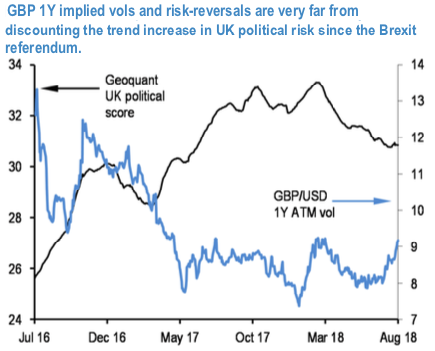

One could argue that GBP vols and risk-reversals have not kept pace with the trend increase in political risks in the UK since the Brexit referendum. Exhibit 3 shows a new-age index of political risks scored by Geoquant based on a mix of structural country risk metrics and higher frequency formal and social media data (GEOQUKPR Index<Go>); its lack of directional correlation with option price based measures of sterling risk suggests that an unpleasant surprise could be in store for GBP options should markets focus more squarely on the no deal scenario.

Considering 1.20 on GBPUSD to be the hard Brexit threshold – not unreasonable since 1.20 is the spot low in the aftermath of the Leave vote in 2016 – pricing on 1Y 1.20 strike GBP put/USD call digital options of 15.7% of USD notional (mid) at current market (1.2776 spot reference) strikes us as being on the low side, on net indicating that option markets assign more than 50% additional probability to a benign resolution to UK/EU. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly GBP spot index has shown -32 (which is mildly bearish), EUR is at -69 (which is bearish), while USD is flashing at 32 (bullish), while articulating at 10:55 GMT.

For more details on the index, please refer below weblink:

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise