The Sterling has stabilised a little overnight, after extending last week’s reversal yesterday. The commodity currencies remain the underperformers, particularly the AUD, with the minutes of the November RBA meeting, released overnight, continuing to highlight an easing bias. The hope perhaps being that a trade deal between the US and China would raise business confidence. As such, trade headlines are likely to continue to cause some volatility in the markets, especially as we have little key data until Friday’s PMI updates from the major nations.

GBPAUD has been edging higher amid short-term corrections in the major uptrend as you could observe in the monthly plotting.

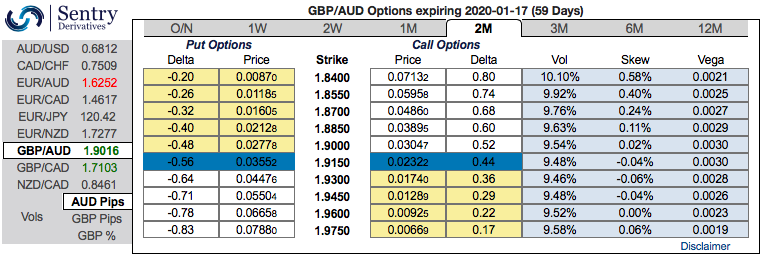

We advocate 3-Way Diagonal Options Spread as 1st hedging option.

Ratio: (Long 1: Long 1: Short 1) at spot reference: 1.9010 levels.

The execution: Initiate long in GBPAUD 2m at the money delta call, long 2M at the money delta put and simultaneously, Short theta in 2w (1.5%) out of the money put with positive theta or closer to zero.

Rationale: Contemplating IV skews, short-term and long-term trends that are well balanced on either side, we could expect both minor price dips in short-term and major uptrend remains intact.

The positively skewed 2m IVs are stretched towards both OTM calls and OTM puts, we reckon that the Delta instruments are conducive to monitor directional risk so as to be aware that how much of option’s value would increase or diminish as the underlying market moves as this option tool measures the value of an option as the underlying spot FX moves. Well, a higher (absolute) Delta value is desirable on long leg in the above stated strategy. Whereas, the Theta is positive on short leg; as the time decay is good for an option writer (that’s why we’ve chosen narrowed expiry).

Hence, we advocate the above options strategy with cost-effectiveness that could hedge regardless of the swings on either side.

Alternatively, hedging no.2, we advocated initiating shorts in GBPAUD futures contracts of October’19 delivery and simultaneously, longs in futures of December’19 delivery.

Thereby, the foreign traders, who are dubious about puzzling swings, can directionally position in their FX exposures. Shorts leg has expired now, we wish to uphold the long leg of December deliveries. Courtesy: Llyods & Sentry

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand