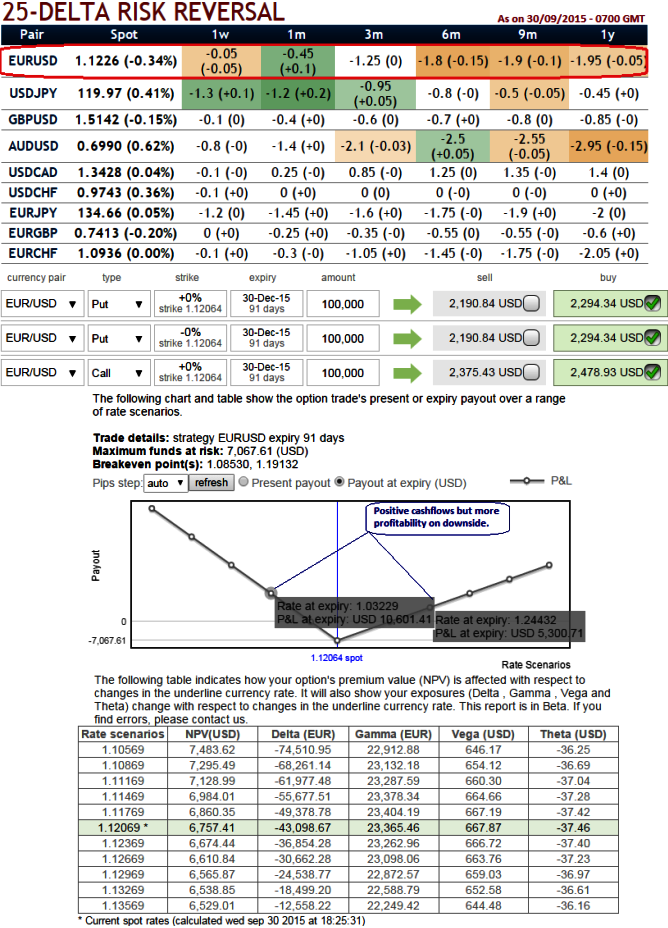

The ATM volatility and delta risk reversal of EURUSD, divulge that the fact that pair would experience little downside pressure in next 1-6 months future with reducing volatilities. The higher side volatility of EURUSD ATM contracts for next 3 months is projected. Although trend is puzzling on either sides the bearish momentum is likely to hold on. Huge volatility is expected over next 1-3 months.

The spot FX EURUSD is flashing up at 1.1201 with negative delta risk reversal has been gradually picking up after 3 months which means fed's rate policy expectation that is scheduled in December cannot be disregarded, an investor may want to protect his asset from downside price risks on euro side. So, he considers buying a EURUSD put assuming scenario that dollar's strength owing to rate hike.

Now, if he is prepared to limit his upside potential on the underlying asset, he can also consider selling a call in order to finance buying the put. In this way, it can be possible to create a position, at no initial cost, that is protected from large downside price movements.

On hedging grounds we recommend buying at the money 1W 0.52 delta call of 1 lot (size 100,000) and two lots of at the money 3M -0.48 delta puts on the other hand. You aren't sure of the direction though, but you favor the downside. Our analysis tells you a southward big move is on the table. You enter a long straddle trade with an extra put in hopes of a move down.

If the strategy gets the move you expect towards down, you'll profit more. If the pair spikes up, that's fine too as it is either going to be hedged or still profits are achievable but you'll need a pretty big move just to get back to breakeven.

FxWirePro: Stay stiff with Strips as delta risk reversal indicates dollar’s gains against euro

Wednesday, September 30, 2015 1:10 PM UTC

Editor's Picks

- Market Data

Most Popular

6

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand