With little new information at hand, we keep our trade recommendations unchanged. The dollar has lost its upward momentum as select high profile drivers of support stalled. However, cyclical conditions are still strong in the US and USD positioning is modestly short ahead of the first FOMC in a year to possibly deliver higher “dots”. Thus, we encourage staying modestly long the dollar vs. CHF and JPY but shorts in near run.

Implied correlations between yen-crosses are rich for a benign post-Japanese election environment bereft of idiosyncratic yen risks; sell USDJPY vs. CHFJPY correlation swaps hedged with USDJPY FVAs.

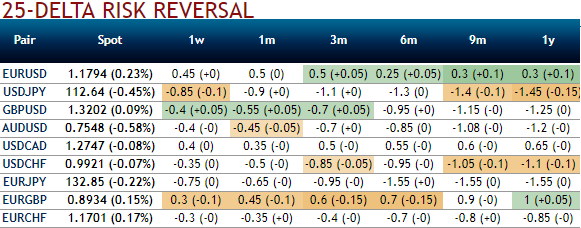

Let’s just have a glance through the implied volatility of ATM contracts of USDJPY across 1w-1m tenors are shrinking lower despite this week’s flurry of data streaks, just a tad below 7.2% and 8.15% for 1w – 1m tenors respectively, while risk reversals have shown negative shift in these tenors but higher negative numbers to signify the bearish hedging sentiments remain intact.

With the help of this OTC setup, the rationale is that any abrupt upswings should be optimally utilized to snap rallies and deploy short puts in order to reduce the cost of hedging.

Thereafter, to arrest potential downswings to the maximum extent regardless of trading or hedging grounds, so to participate in that downtrend, weights of the long leg in hedging portfolio should be increased with more number of put contracts but consciously while choosing the right delta instruments.

Implied volatility is an important factor to consider in options trading because the prices of options are directly affected by it. A spot rate with a higher volatility will have either had large price swings or is expected to, and options based on a security with a high volatility will typically be more expensive.

Please also be noted that the IV skewness is very conducive in determining this decision, here in case of USDJPY, the positively skewed IVs are signifying the importance of OTM puts but not deep out of the money puts (2m skews are suggesting strikes maximum upto 110). This bearish sentiment is in sync with the mounting negative risk reversals that again indicates further bearish risks.

A smart approach to tackle this risk sentiment and potentially profit from volatility is to create a delta neutral position on a security that you believe is likely to increase in volatility. The simplest way to do this is to buy at the money contracts or OTM strikes but certainly not deep OTM strikes.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts