Amid the June Bank of England MPC vote split in which three members voted for an immediate rate hike and the recent flurry of speeches from officials, we have yet to hear from Deputy Governor Ben Broadbent. He is scheduled to speak in Aberdeen at midday. He voted with the majority to leave rates unchanged, but his views on the trade-off between elevated inflation and softer economic growth will be closely examined. Dr. Broadbent is seen as a centrist or moderate dove. BoE Chief Economist Andy Haldane also speaks today, but the topic is on numeracy rather than policy.

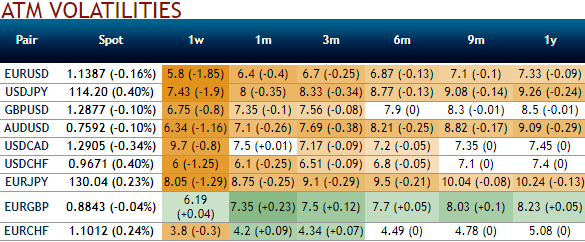

Please be noted that the implied volatilities of GBPUSD ATM contracts from the nutshell evidencing ATM IVs of all expiries have been shrinking below 7.5%, in addition to that the underlying spot FX has been in range bounded trend and it has been foreseen to persist further in near future. If you have the short leg in your options strategy, it is quite good to expect vols shrinkage. An option writer wants IV to fall so the premium falls. You should also note short-dated options are less sensitive to IV, while long-dated is more sensitive.

We retain our bearish bias, with short-term price action relatively conducive – we spent most of the yesterday’s session testing and consolidating below 1.2890. A clear break of the 1.30-1.31 resistance is required to negate our bias and opens the 1.3375-1.3450 resistance region. BoE speakers pose a risk today. Otherwise, we bet for southward targets of 1.2829 levels again.

Contemplating major downtrend of GBPUSD, we advocate staying short hedged via diagonal debit put spreads by adding long in 2m (1%) in the money -0.66 delta put, while simultaneously, shorting 1m (1%) out of the money put option at net debit.

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom