Long vega priced well in NZD, CHF and SGD: Amid heightened sensitivity of macro markets to US inflation data and increasing discomfort about the twin US deficits FX vols should remain supported. FX vol ownership at belly of vol curve is particularly appealing.

We backtested a rule-based heuristics to owning long vega –i.e. systematically rotating long vega ownership across USD/G10 & EM based on a composite trading signal -constructed from three signals: 1-year z-score of CTP (carry to-premium ratio), the strength of spot trend and 1-year z-score of realized/ATM vol ratio. The rule-based trading made long vega worth sustaining 3-5 vol pts of theta-decay annually, on average, in calm markets.

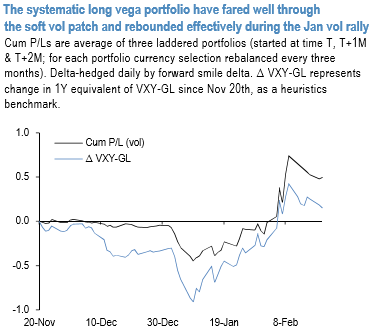

The above chart shows the recent (out-of-sample) performance of the strategy. The systematic portfolio (three 1Y tenor straddles selected monthly and held for three months in laddered portfolios started at time T, T+1M & T+2M) have fared well through the December soft vol patch and rebounded effectively during the January vol rally.

In the current market, the three vega longs that stand out based on the composite systematic signal are NZD, CHF and SGD vols. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025