On swing trading perspectives, we are recommending to buy 1M 1% in the money 0.68 delta calls and simultaneously short 1w (0.5%) out of the money call with positive theta, the combined delta value should be around 0.33.

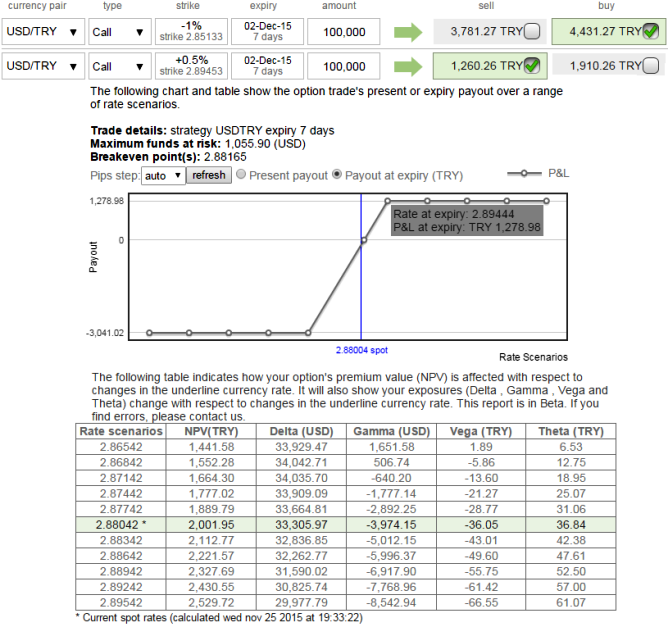

We've shown in the diagram as to how the strategy can be built in. However, for the demonstration purpose only we've used the identical expiries but shorter expiries on short side are preferred.

Why this call spread: Since September-2015, we've been firmly bullish that is articulated in our every post about USD/TRY. The driving force was majorly due to the technical structure of the monthly USD/TRY charting pattern though, where it wasn't coupled with the fundamental composition. For now, we could still foresee USDTRY at around 3.20 by end-2016.

Since a short term correction is anticipated on this pair and long term uptrend seems intact, with a view of not missing out of these swings and extracting maximum leverage from these swings, an OTM call shorting is advised.

An investor often employs the bull call spread in moderately bullish market environments, and wants to capitalize on a modest advance in price of the underlying asset. If the investor's opinion is very bullish on USDTRY, it will generally prove more profitable to make a simple call purchase.

Risk Reduction: An investor will also turn to this spread when there is discomfort with either the cost of purchasing and holding the long call alone, or with the conviction of his bullish market opinion.

Risk/Reward Profile: Maximum loss for this spread will generally occur as the USDTRY declines below the lower strike price (i.e. 2.9141). If both options expire out of the money with no value, the entire net debit paid for the spread will be lost.

The reward is that the bull call spread tends to be profitable when the USDTRY increases in price. It can be established in one transaction, but always at a debit (net cash outflow). The call with the lower strike price will always be purchased at a price greater than the offsetting premium received from writing the call with the higher strike price.

Please refer our previous posts about our bullish stance on TRY:

http://www.econotimes.com/FxWirePro-USD-TRY-shooting-star-formed-at-peak-TRYs-healthy-macro-dynamics-unlikely-to-tame-dollars-bull-run-but-tiny-corrections-on-cards-70081

FxWirePro: Stay long in USD/TRY via debit call spread on healthy uptrend

Wednesday, November 25, 2015 2:11 PM UTC

Editor's Picks

- Market Data

Most Popular