Canada is currently at the receiving end of extreme US aggression in the trade conflict. As a result, the Bank of Canada will be cautious at its meeting today and will hope that the NAFTA negotiations can be concluded successfully, which would then give it scope for further rate hikes.

That means that for the Canadian dollar the BoC’s rate decision today is an aside. The focus rests clearly on the trade negotiations between the US and Canada that are going to be continued today - it is all or nothing for CAD. Of course, the US is the most important trade partner of Canada by a long margin so that Canada cannot afford to risk the negotiations failing and the trade agreement coming to an end.

However, Canada can rely on important allies in the US: in Congress, where all trade agreements have to be ratified, resistance is forming against an agreement between the US and Mexico, excluding Canada. This strengthens the Canadian negotiating position but also increases the risk of a possible failure of the negotiations. The resulting risk premium is putting pressure on the Canadian dollar. Further losses are possible unless an agreement emerges.

The Bank of Canada’s rate decision (in our perspectives, overnight rates would remain unchanged this time following a rate hike in July) takes the back seat compared with the trade conflict, and CAD will remain at the mercy of the news flow on the progress of the trade negotiations for now.

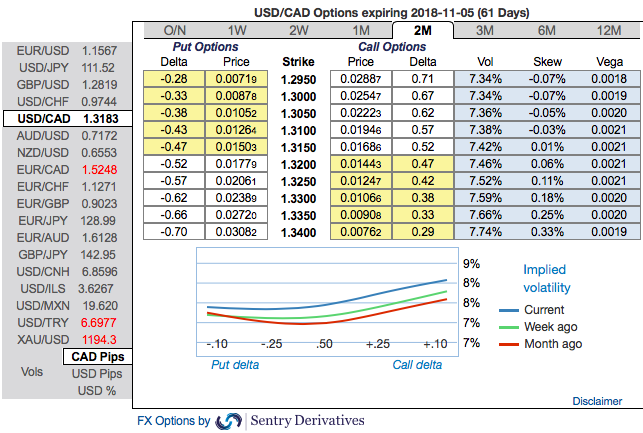

USDCAD OTC outlook:All these driving forces seem to be factored-in OTC markets. Please be noted that the positively skewed IVs of 2m tenors signify the hedgers’ interests to bid OTM put strikes upto 1.34 levels (refer above nutshell evidencing IV skews). As you could observe USDCAD forward rates across different tenors (refer above 2ndchart), these derivatives instruments indicate bullish targets of this pair.

Positive bids of risk reversal of loonie (USDCAD) is also signalling bullish risks in across tenors (refer above nutshell showing risk reversals). A risk reversal is an over-the-counter (OTC) structured forward that is predominantly utilized as a hedging solution. The RR proposes the probability of benefiting to a limited extent from an appreciation of the foreign currency you are exposed to. You are hedged at a predefined exchange rate which is slightly worse (if unleveraged) compared to the Outright Forward rate. You can enhance the hedge rate with the use of leverage how- ever, your foreign currency exposure is then only partially hedged (Leveraged Risk Reversal). Courtesy: Commerzbank

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at -43 levels (which is bearish), while hourly USD spot index was at 78 (bullish) while articulating at (09:27 GMT). For more details on the index, please refer below weblink:

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal