With increased focus on repricing and reassessment of DM interest rates and monetary policy, G10 FX forecasts have had more revisions than EM FX forecasts in the past month. The better data has prompted our economists to adopt a more hawkish forecast on several G10 central banks—we no longer expect the RBA to cut rates by 50bp, the Riksbank is now expected to hike rates in April 2018 versus the prior expectation of July and the BoE is now expected to deliver a 25bp rate hike in November this year and two more in 2018.

Asymmetric uptick in G10 vols is more difficult to envision, since the mix of Fed repricing and tax reform optimism may draw a soft floor under the greenback for the time being even if this week’s upturn does not repeat, and coupled with the somewhat panicky unwinding of Euro (and other European FX) longs might leave macro investors less willing to spend option premium to play for EUR resurgence.

In this situation, if one had to pick one Eurobloc currency to buy vol in, our preferred pick would be GBP, especially on the crosses. We continue to believe that the abrupt shift in BoE policy and the attendant possibility of a policy mistake make sterling a fundamentally more uncertain currency than many others.

The range of spot outcomes on cable has now opened up from a previously narrow 1.28-1.30 band to a much wider 1.28 - 1.36 (or higher) which ought to command a higher premium in implied vols than before.

Yet GBP implied vols have retraced 3/4ths of the ramp up from earlier this month, and the recent realized vols are clocking 1 vol above short-dated implieds, hence this appears to be a case of underpriced fundamental uncertainty with supportive technicals for gamma ownership. GBPCHF (GBP vs. CHF implied correlation 40%, realized corrs 35%) in particular strikes as a useful long within the GBP-cross complex, we prefer financing it via shorts in EURCHF.

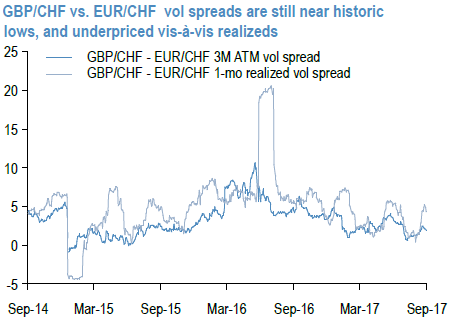

The GBPCHF – EURCHF vol spread has picked up from 15y lows but is still stuck near the bottom-end of a long-term range, the vol spread has a desirable tendency for one-sided eruptions in favor of a wider GBPCHF premium during market crashes, and enjoys a healthy positive carry at inception (2M ATM vol spread 1.9 mid, realized vol spread 4.0 on 1w and 4w look backs using hourly spot data; refer above chart). Courtesy: JPM

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different