With the global investors’ risk aversion heightens significantly amid trade turmoil, USDJPY bears resume again. While we continue to project USDJPY to trend lower in 2H’2018 with the year-end target below 107 levels and 1Q’2019 target at 104. The downward trend would be justified by the risk factors as discussed above. Meanwhile, we see a low probability that these risks realize; hence, risk factors would weigh on USDJPY but not lead to a sizable and long-lasting decline in the pair. Beyond that, we expect the pair to rebound in 2Q’2019 as risks fade.

If you ponder upon cost effectiveness and wouldn’t like to divert exposure, we advocate buying USDJPY 1w/1m put ratio back spread strikes 111.634/109 (2:1), (vanilla: 0.75%, spot ref: 110.665 levels). A 2:1 put back spread can be implemented by buying a number of puts at a higher strike and buying twice the number of puts at a lower strike.

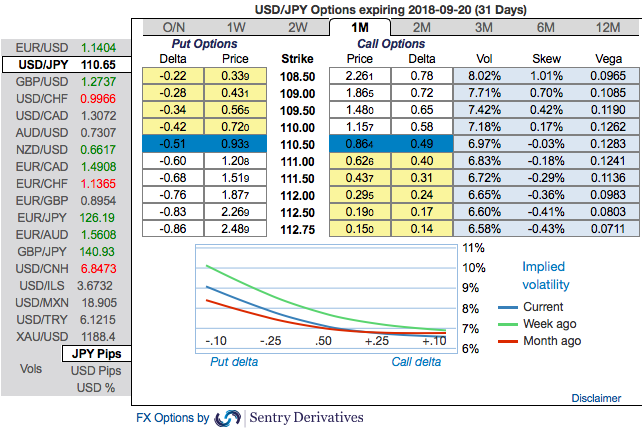

Rationale: The implied volatility of ATM contracts of USDJPY is trading back towards 6.47% and 7.47% for 1w/1m tenors respectively, as the positively skewed IVs of 1m tenors signify the hedging sentiments for the further downside risks upto 108.50 levels, this appears to be conducive for put option holders. On the flip side, it is wise to utilize abrupt rallies amid shrinking vols in the below-stated options strategy.

This bearish sentiment is substantiated by the mounting negative risk reversal (RRs) numbers, and negative RRs indicate the hedging sentiments for the bearish risks appears to be intact.

What makes strategy more attractive: Short leg (OTM shorts) of this strategy would have reduced cost of hedging, while a deep in the money call with a very strong delta will move in tandem with the underlying as the underlying spot FX has potential for further dips.

The short leg with narrowed expiry likely to benefit time decay advantage which in turn reduces hedging cost on long leg of ITM put.

Currency Strength Index: FxWirePro's hourly JPY spot index has shown -3 (which is neutral), while hourly USD spot index was at -20 (mildly bearish) while articulating at 09:40 GMT. For more details on the index, please refer below weblink:

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation