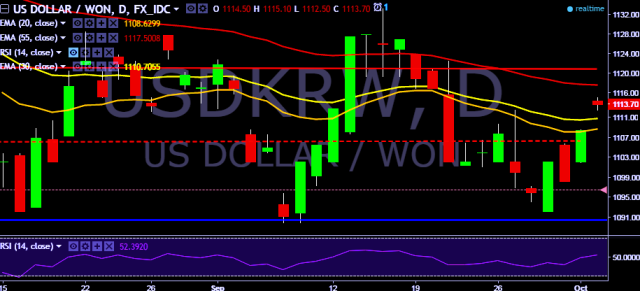

- USD/KRW is currently trading around 1,113 levels.

- It made intraday high at 1,115 and low at 1,112 marks.

- Intraday bias remains bearish till the time pair holds key resistance at 1,117 levels.

- A daily close above 1,117 will drag the parity higher towards key resistances at 1,125, 1,142, 1,152, 1,162, 1,176, 1,182, 1,196, 1,201, 1,209 (20D EMA) and 1,220 (March 03, 2016 high) marks respectively.

- On the other side, a sustained close below 1,101 will test key supports at 1,089/1,078/1,063/1,044 levels respectively.

- In addition, South Korea’s Kospi was trading around 0.05 percent lower at 2,053.52 points.

- South Korea’s September CPI growth Y/Y increase to 1.2 % (forecast 0.80 %) vs previous 0.4 %.

- South Korea’s September CPI growth increase to 0.6 % (forecast 0.20 %) vs previous -0.1 %.

We prefer to go short on USD/KRW around 1,115 with stop loss at 1,122 and target of 1,107/1,101.