- USD/ZAR is currently trading around 12.74 levels.

- It made intraday high at 12.78 and low at 12.73 levels.

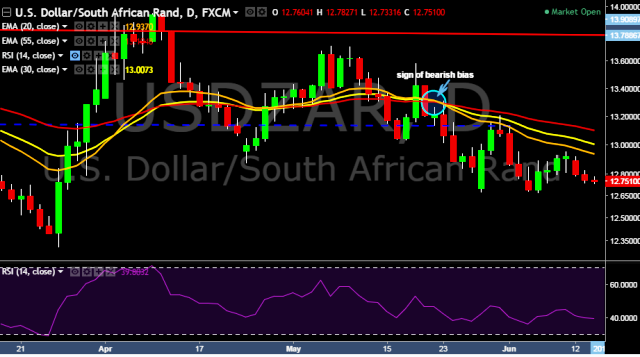

- Intraday bias remains bearish till the time pair holds key resistance at 12.82 mark.

- A daily close above 12.82 will take the parity higher towards key resistances around 12.95, 13.14, 13.21, 13.31, 13.42, 13.58, 13.70, 13.95, 14.16, 14.29, 14.50, 14.75, 14.96, 15.05, 15.28 and 15.45 marks respectively.

- Alternatively, a daily close below 12.82 will drag the parity down towards key supports at 12.67, 12.48, 12.30, 12.22 and 12.14 levels respectively.

- Important to note here that 20D, 30D and 55D EMA heads down and confirms the bearish trend in a daily chart.

We prefer to take short position in USD/ZAR only below 12.72, stop loss at 12.95 and target of 12.48.