We firmly maintain our bearish stance in ZAR, with the South African rand screening as exorbitantly priced versus the dollar, even as the domestic political story has suffered a meaningful shift. The rand now appears to be pricing in “positive" political risk premium, as recent events have weakened President Zuma’s position and increased the chances of a “regime change”.

While it is hard to create a precise measure of “regime change hopes”, the number of Bloomberg news stories evidence the relevance to the President Zuma being under pressure and it has spiked in recent days.

The current market price action differs from previous political episodes, where USDZAR has frequently priced negative political risk premium related to risks that Finance Minister Gordhan could be dismissed.

While the changed political landscape suggests the medium-term picture is shifting more positive, we remain tactically bearish ZAR:

USDZAR is now trading too low to our models and too low compared to the global risk environment. On our short-term model vs. CDS and an export commodity index, USDZAR fair value is now 13.82, normally the export commodity index delivers the similar result to just using platinum in the regression, with USDZAR exhibiting the highest beta to platinum.

However, given the recent strength in iron ore, we currently prefer to use the export commodity index to capture the iron ore effect.

On platinum and CDS, the fair value would be 13.95. USDZAR has now also clearly diverged from the rest of EM FX, with other EM currencies recently trading weaker vs. the USD on concerns around rising G3 yields and on US election risks.

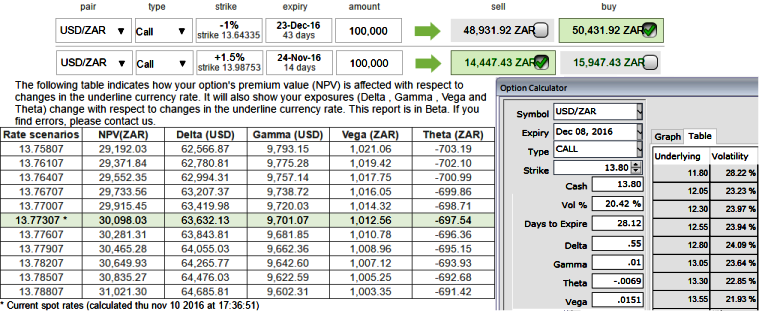

Hence, we upheld the long positions in USDZAR in option spreads, cash trades were not preferred on account of high yield IVs, 1m ATM IVs are spiking shy above 20.40%.

Anticipating further price upswings in the underlying spot of USDZAR, on hedging front, we recommend positioning long USDZAR (ZAR has been significantly overshooting fundamentals), which makes buying USDZAR vol all the more appealing.

In naked vanilla form, we suggest call spreads at the 1M horizon, optimizing strikes for leverage. In USDZAR, the 1M-2M ATM spread is below average at +0.75, as 1M vols had remained relatively anchored and never softened significantly. One could initiate their option trades as shown in the diagram, but use appropriate strikes and tenors as per the requirements.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty