The speed of the correction in EM FX has surprised us, but we remain cautiously pro-carry in our region, given supportive valuations.

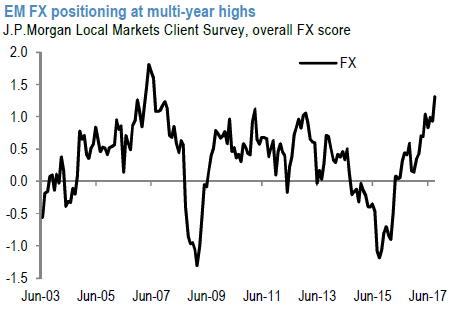

Over the past two weeks, EM FX weakened sharply across the board (refer above diagram). This was driven mainly by repricing of US yields and a stronger dollar. Yet, we believe stretched FX positioning likely contributed to the sell-off (refer above diagram).

We took a more cautious stance already in our EMEA EM Local Markets Compass on September 8, where we added UW RON as a hedge to EURUSD moves.

We subsequently also added UW ZAR on September 14. While we keep these two hedges in place, our overall portfolio remains net pro-carry via OW TRY and OW RUB. With EM fundamentals improving and the correction over the past two weeks taking most of the currencies in our space cheap on short-term and long-term valuation metrics, we believe net pro-carry bias remains the right strategy in our region.

As per JP Morgan’s recommendation, the long positions are continued in TRYZAR cash trade and are OW TRY in the GBI-EM model portfolio. The main challenge to our long TRY exposure has been a relatively heavy FX positioning. For instance, the JP Morgan Local Markets Client Survey showed a 3.6 score as of September 21.

However, with the recent sell-off in lira and concerns over Kurdistan weighing on the currency, we believe the positioning is much cleaner now. Meanwhile, lira’s high yield continues to offer an adequate reward for the macroeconomic and political risks facing the country, in our view, in sharp contrast to South Africa.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge