The US President Donald Trump continues to provoke. On Friday he fuelled concerns via Twitter that the trade war could turn into a currency war. The US dollar depreciated significantly after Trump explicitly accused the EU and China of manipulating their currencies to gain an unfair trade advantage.

Apparently, the unfazed by the accusations of FX manipulation from Washington the Chinese central bank PBoC emphasizes that its monetary policy guidance would focus on counterbalancing the downside risk for growth. Additionally, to a supplementary liquidity injection, the new rules for the asset management sector were less restrictive than expected. That too is a clear signal that the risk of weaker growth is seen as being more urgent than deleveraging that monetary policy was still focussing on at the start of the year.

That means the PBoC is laying the foundations for further CNY weakness. Is that unfair, as the US is claiming? We cannot exclude that the PBoC takes its monetary policy decisions also with a view to its currency and that it hopes a weaker renminbi might fuel exports.

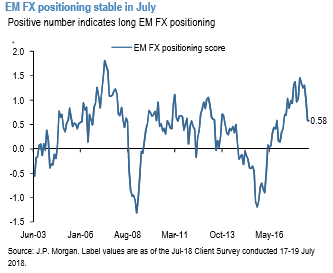

EMFX positioning stays modestly OW despite the recent market underperformance. As per the latest J.P. Morgan’s local markets client survey from 20th July shows that the EMFX positioning score stabilizing at 0.58 for a second consecutive month (Refer 1st chart). This follows a relatively large reduction from 1.31 in April 2018.

However, despite the market rout, investors are overall holding on to long exposure in EMFX. This remains a source of vulnerability. EM investors marginally reduced FX positioning across EM Asia and Latam while marginally adding risk in EMEA EM. The lack of large overall moves masks the changes between low and high yielding FX (Refer 2nd chart). Most of the risk reduction that occurred in July was in the low yielding EM FX currencies: SGD and MYR in EM Asia, and HUF and PLN in EMEA EM.

Meanwhile, investors selectively increased exposure to existing large positions in high yielding FX: INR in EM Asia, ARS and MXN in Latam, and RUB in EMEA EM. The marginal increase in the aggregate EMEA EM FX score was mainly due to RUB, where investors reversed most of the reduction that occurred on the geopolitical tension in April and May.

We recommend relative value positions while avoiding exposure to global trade tensions. We continue to see some signs that EM FX risk appetite can recover, however, risks and vulnerabilities remain very high, with trade tensions and geopolitics at the centre of our concerns. We are therefore cautious in our own portfolio, staying MW and focusing on picking currencies that can recover while holding on to FX hedges that should perform well on an escalation in global growth risks and trade tensions (e.g. ZAR). Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is at shy above -24 levels (which is mildly bearish), while articulating (at 14:07 GMT). For more details on the index, please refer below weblink:

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed