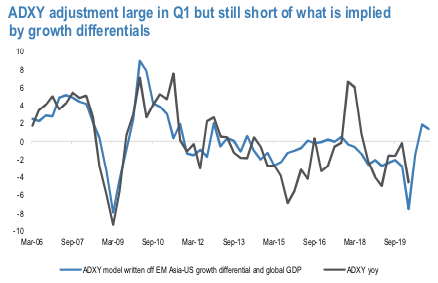

While the adjustment in EM Asia FX in Q1 has been meaningful, it still fell short of growth differential-based model predictions (refer 1st chart). ADXY’s 4.5% y/y drop is 3% less than the move implied by EM Asia-US growth gap and the global growth pulse – i.e. a sharp sell-off by itself has not injected unjustified risk premium into Asian FX.

JPM projections of EM Asia’s growth outperformance in Q2 is predicated on the view that the COVID-19 outbreak will have a larger negative impact on services-heavy DM economies. Still, DM capex intentions are unlikely to meaningfully rebound amid such broad economic malaise, which should keep Asian export growth, and by extension Asian FX under pressure (refer 2nd chart).

Central banks around the region are looking to stem the pace of declines in their respective FX rates. Korea recorded a sharp fall in FX reserves in March, with the headline number down just over $9bn. In India the drop has been larger, at closer to $12bn, whilst Thailand is off sharply from the early March peak. There is some buffer though, with central banks within the region generally above the reserve adequacy metric computed by the IMF. The magnitude of the drawdown in FX reserves, particularly in an economy like Thailand, where the central bank has outlined the case for a weaker exchange rate, shows the extent to which capital outflow/current account pressures have intensified. We now expect Thailand to have a BoP deficit in Q1 and this is a key factor for a continued short position in the FX.

IDR has remained under significant pressure. The continued sharp drawdown in foreign bond holdings and a wide current account deficit have been the key drivers of this weakness. This has pushed the IDR REER to more than 10% below its 10 year moving average, while the degree of dislocation with the current account deficit has also been removed. Still, given Q2 seasonals are a headwind for the currency, particularly in May, it is arguably too soon to dive into any fresh long IDR positions. The pace of DNDF issuance has also stabilized over the past month between $6-7bn, which suggests the authorities are not leaning as much against FX weakness as they were through February.

INR has fared better but we believe is further behind from an adjustment stand point. The RBI appears to be mindful of the pace of INR depreciation but we expect the asymmetric intervention bias to persist. The rupee has not caught up with the growth downgrades seen in recent months (refer 3rd chart), whilst equity outflows, on a rolling 6 month basis have only just crossed below the zero bound. The REER also remains elevated to history.

In terms of trading recommendations, we remain long USDTHB and USDTWD as outright trades. TWD can still play catch up with the sizeable equity outflows and reduced imported inflation pressure, while short THB is a play on extended pain in Thailand’s services (tourism) balance.

Finally, we are long a reduced SGD basket to benefit from Singapore’s robust external balance that lends SGD TWI resilience in a global recession, and also the likely end of the MAS easing cycle after this week’s re-centering and slope flattening.

Contemplating above factors consider: 1M At-Expiry-Digital (USDINR >2% OTMS; USDKRW > 2% OTMS; USDSGD > 2% OTMS) call @ 2.8/4.8% indicative.

1M ATMS worst-of basket USD ATM call on (USDINR, USDKRW, USDSGD) @ 0.225/0.275% indicative. Courtesy: JPM

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts