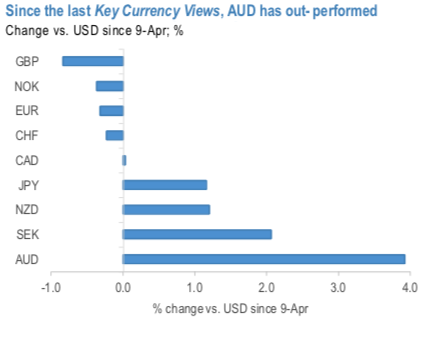

AUD has been the standout performer within G10 (refer 1st chart). Most of this rally occurred during April, and since then AUD has traded a very tight range (0.6370-0.6530). One new development for AUD has been an escalation of trade tensions with China. However, we have not made any changes to our forecasts; we see AUDUSD at 0.63 by mid-year (expecting some near term seasonal under-performance) and 0.65 by year end.

RBA is scheduled for their monetary policy for this week, of late, Aussie central bank’s policy settings have remained unchanged since being announced on 19 March. The Bank remains committed to leave the cash rate at current levels until “...progress is being made towards full employment and it is confident that inflation will be sustainably within the 2–3 per cent target band.” What has changed has been an easing of restrictions as Australia has made significant gains in managing the COVID-19 outbreak (refer 2nd chart). This gives us greater confidence in our central case forecast for a return to growth in 3Q’20.

The latest development for AUD has been an escalation of trade tensions with China (refer 3rd chart). Senior Chinese diplomats have recently expressed displeasure with Australia's support for an international inquiry on the origins of COVID-19 and have threatened the possibility of economic retaliation. In addition, China has raised the potential for 80% tariffs on Australian barley (in response to alleged dumping behaviour) and has this week banned imports from four Australian beef processors. The Australian government has so far played a straight bat to much of this noise, but it does serve to highlight that risks to Australia's exports to China are very asymmetric in a post COVID world where relations deteriorate and China uses economic coercion to punish Australia. This is a potentially large source of downside risk for AUD, and one that may cap any upside for AUS that exists on the basis of a relatively earlier return to economic activity, still solid iron ore prices and the RBA's "QE-lite" compared to other central banks.

We advocated shorting AUDUSD futures contracts of mid-month tenors on hedging grounds, we wish to uphold the same strategy as the underlying spot FX likely to target southwards below 0.65 levels in the medium run (spot reference: 0.6750 levels). Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position. Courtesy: JPM

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist