A number of key US data releases which were due today, including the ADP employment and ISM non-manufacturing reports, that have been moved to tomorrow due to the national day of mourning for former President George H. W. Bush. Fed Chairman Powell’s testimony to Congress has also been postponed to a date as yet unspecified.

But BoC’s monetary policy is the major news during US session. Well, there has been a consensus about the fact that the Bank of Canada (BoC) to maintain status quo in this policy leaving its key rate unchanged at 1.75%. First and foremost, it had just hiked its key rate by 25bp at its October meeting, and secondly uncertainty surrounding the economic and inflation outlook has increased since then which points towards a more cautious approach.

Admittedly this is not a Canada-specific issue. Global economic concerns are currently generally dampening rate hike expectations, but the rapid fall of the oil price since early October is putting additional pressure on the Canadian economy.

As a result, the market has priced another rate hike in January in at only 60% now. We remain slightly more optimistic regarding the economic and inflation momentum and still consider a rate step in early 2019 to be very likely. The downside potential in USDCAD is nonetheless limited as the BoC is unlikely to propose a much more aggressive approach than the Fed so as to not risk strong CAD appreciation – experience it gained in 2017 and that it is likely to have learnt its lesson from.

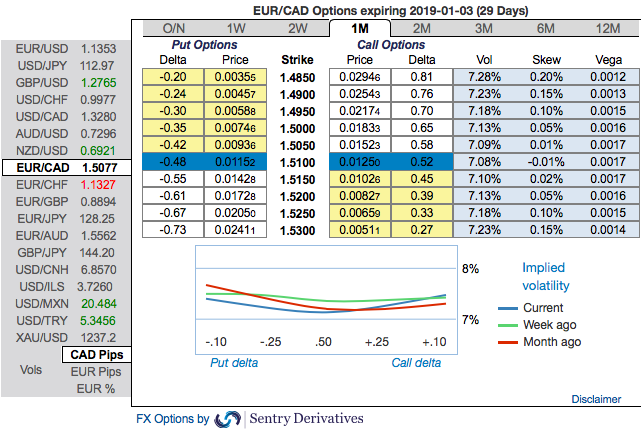

CAD OTC indications: 1M ATM IVs (implied volatilities) of USDCAD are trading in the range of 6.76% - 7.09%, skews are also suggesting the odds on OTM call strikes upto 1.35 levels at this juncture. While 1m EURCAD IVs have been well balanced on either side, indicating the risk sentiments are skewed for both bullish and bearish risks.

We could also notice fresh bids for 1w-1m risk reversals that signals both upside and downside risks respectively, and the bullish risk-neutral distribution of returns in the long-run. Also, the IV curve is at, or slightly decreasing, with maturity.

In general, it is reckoned that favouring optionality to directional trades likely to fetch desired results as we are inclined to position for unforeseen swings in both near and long terms, as calling the bottom is quite difficult and adding naked spot exposure is risky at the moment. Courtesy: commerzbank

Currency Strength Index: FxWirePro's hourly USD is inching towards -9 (which is absolutely neutral), hourly CAD is at -82 (bearish) while articulating (at 12:48 GMT).

For more details on the index, please refer below weblink:http://www.fxwirepro.com/currencyindex

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed