Ichimoku analysis (4-Hour chart)

Tenken-Sen- $27.19

Kijun-Sen- $26.48

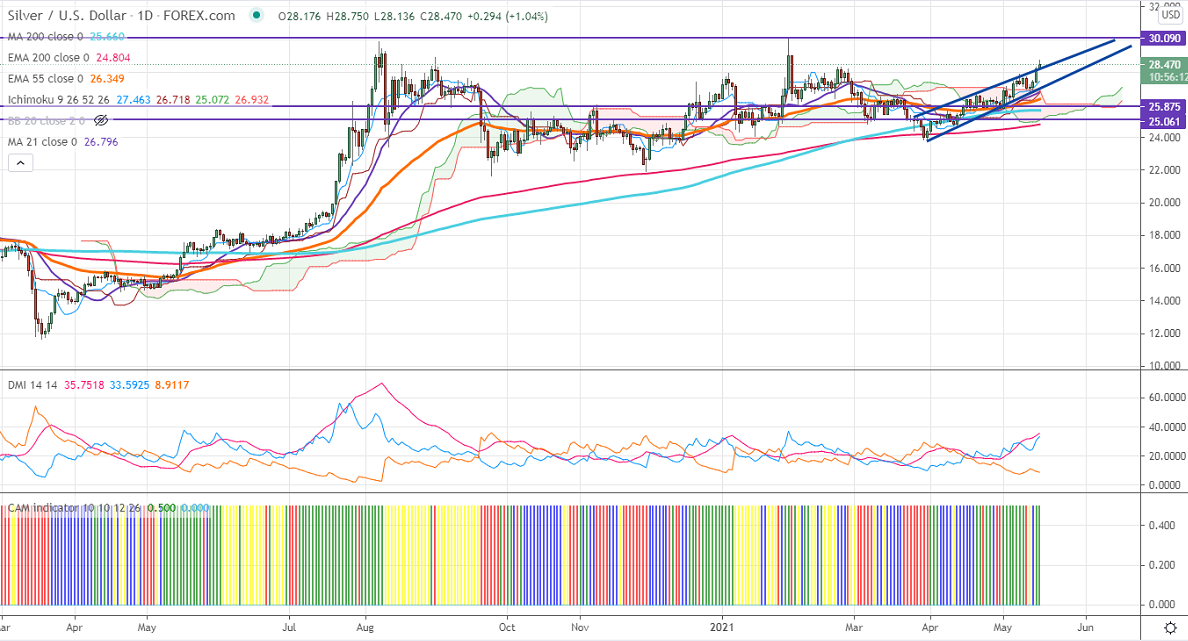

Silver has taken support near ascending channel and shown a massive recovery of more than $1.5 on board-based US dollar selling. The commodity hits a 3-1/2 month high at $28.75 and is currently trading around $28.46. The dovish comments from fed members are supporting the precious metal at lower levels. The overall trend is on the higher side as long as support $26.70 holds. The US dollar index is trading below 90 levels. A dip to 89.20 likely. XAGUS hits an intraday high of $28.75 and is currently trading around $28.48.

Technically, silver's significant support is around $28.35, violation below will drag the pair down to $28/$27.59/$27/$26.69. Significant bearishness can be seen only if it breaks below $24.60.The near-term resistance is at $29, any surge past targets of $29.35/$30.10 is possible.

Indicator (Daily chart)

CAM indicator –Bullish

Directional movement index – Bullish

It is good to buy on dips around $28.30 with SL around $27.70 for TP of $30.