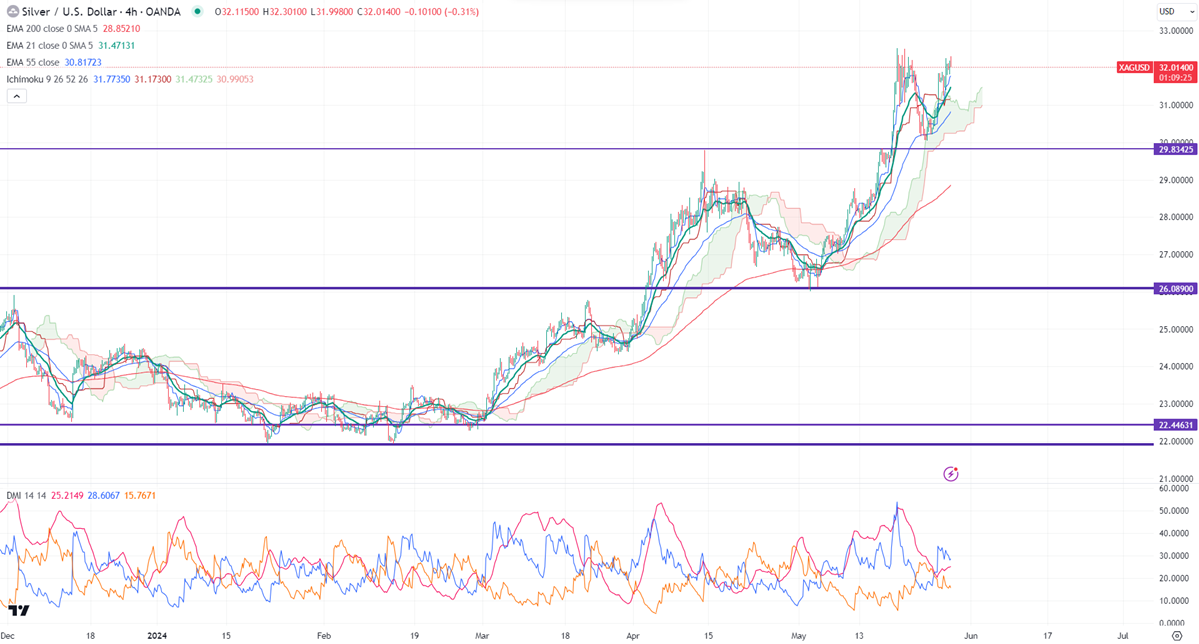

Ichimoku analysis (4-hour chart)

Tenken-Sen- $31.74

Kijun-Sen- $31.14

Silver held above $32 despite the strong US dollar. It hit a high of $32.30 at the time of writing and is currently trading around $32.03.

The surge in US treasury yields puts pressure on silver at higher levels. The conflict between Israel and Hamas prevents silver from further downfall.

Major economic data for the day

US Richmond Manufacturing Index (2 pm GMT)

Beige Book (6 pm GMT)

Gold-silver ratio-

Gold/Silver ratio- 73.45. The ratio decreased from 91.67 to 73.11, well above the historical average of 52. So silver will outperform gold. It is good to buy silver at lower levels compared to gold.

Major trend reversal level -$32.50

It trades above 21 and above 55- EMA, and 200 EMA in the 4-hour chart. The near-term support is around $30 and a break below the target of $29.25/$28.48. On the higher side, immediate resistance is around $32.50 and any breach above targets is $33/$35.

It is good to buy on dips around $31.40 with SL around $30 for TP of $35.