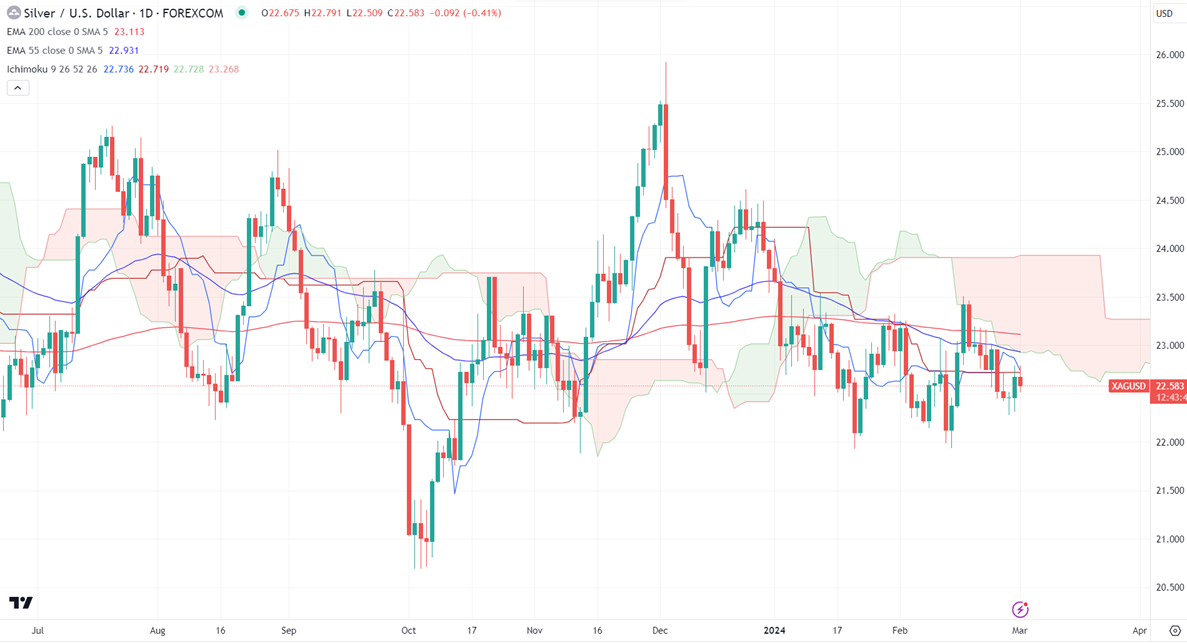

Ichimoku analysis (4- hour chart)

Tenken-Sen- $22.55

Kijun-Sen- $22.61

Silver jumped slightly after hitting a two-week low of $22.27. The pair is edging towards a bearish channel resistance of $22.70-72. Any breach above that channel will push the Silver price to $23/23.50.

Economic Indicator-

US PCE - below estimate (Positive for Silver)

Chicago PMI- Weak (negative for Silver)

Gold-silver ratio-

Gold/Silver ratio- 90. It indicates silver is at the oversold level and outperforms compared to gold. It is good to buy silver vs gold.

Major trend reversal level -$23.60.

Any strong violation above $23.60 confirms a bullish continuation. A jump to $24.20/$24.60 is possible.

It trades below 21, 55- EMA, and 200 EMA in the 4-hour chart. The near-term support is around $22.25 and a break below $22.20 targets $21.90/$21.40/$20.68.