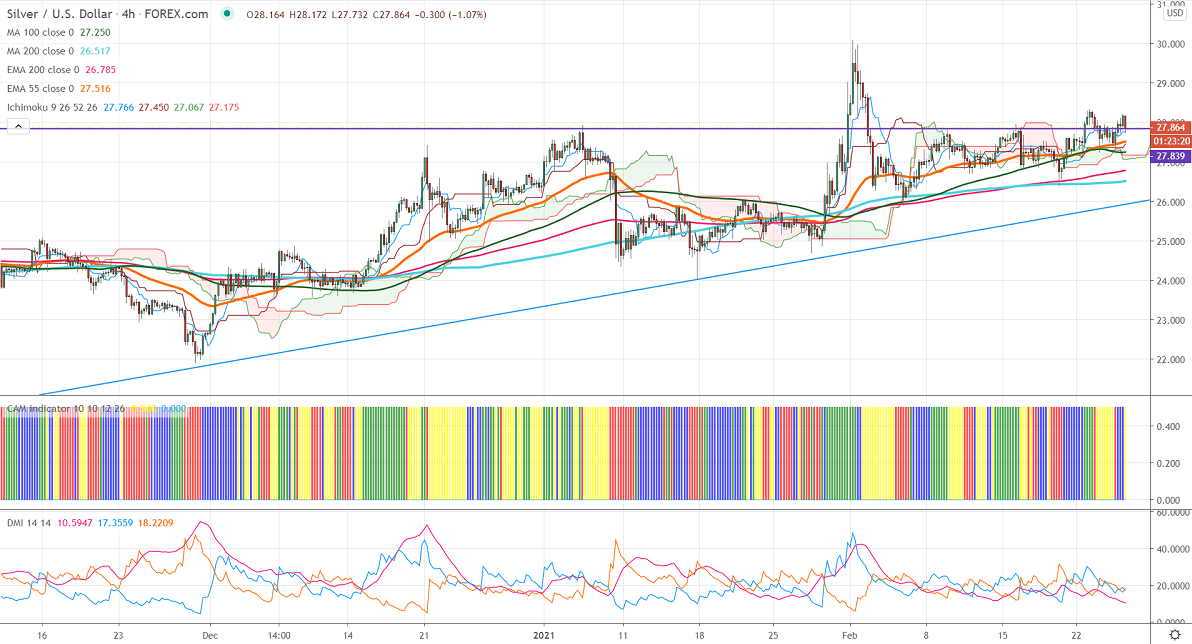

Ichimoku analysis (4- Hour chart)

Tenken-Sen- $27.76

Kijun-Sen- $27.36

Silver has taken support near 200- 4H MA and shown a nice recovery. Short term trend is still bullish as long as support $26.40 holds. The silver was one of the best performers this year and hits a fresh year at $30.13 on increasing demand and weak US dollar. The sliver slightly outperforming Gold as the Gold/silver ratio hits a 6-year low. DXY is trading well below 90 levels. A dip till 89.30 likely.

Technically, silver's significant support is around $27.20, violation below will drag the pair down to $26.80/$26.40/$25.90. The near-term resistance is at $28.35, any surge past targets $28.62/$29/$30 is possible.

It is good to sell on rallies around $28.25-30 with SL around $29 for TP of $25.90.