OTC Outlook:

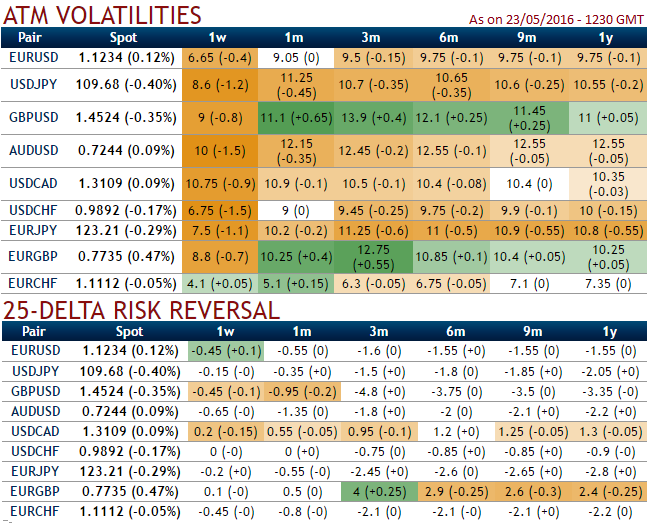

The current ATM IVs are at 9.12%, likely reduce to massively at 7.5% for 1w expiries, even 1m tenors show reducing vols. While risk reversal still divulges bearish sentiments lingering in EURJPY OTC FX market after positive adjustments in 1w expiries. But long term hedging positions still reveal the further downside risks in this pair.

What if a risk-off phase materializes? With steady rise in oil prices, continued woes in China and the recovery in dollar, risk conditions could turn shaky soon and the yen would be a winner.

Near term, short EUR/JPY takes advantage of both a stronger yen and dollar via a lower EUR/USD. As a euro short, it would also hedge a Brexit scenario.

While, the EUR/JPY 2m risk reversal is trading at extreme historical highs in favour of yen calls, close to the peak at -2.5 vols.

The options market is pricing that yen appreciation will be more volatile than a yen fall. This does not necessarily mean that the spot will move significantly but rather that downside price action is expected to be more erratic.

Contemplating these attributes we've come up with below hedging strategy so as to mitigate the risks of this currency cross.

The execution:

This strategy is short volatility, which is attractive as the 2m implied vol is trading one volatility point above the realised volatility (positive risk premium).

Buy EUR/JPY 2m put spread 1x2, strikes 122.130/119 Indicative offer: zero cost (spot ref: 122.750)

The profile is however selling convexity, such that a very fast downside move would deteriorate the mark to market.

In that event, investors may have to dynamically manage the delta to avoid losses. The positive theta makes it a natural buy-and-hold strategy, as the structure pays off its maximal leverage if the spot trades close to the 119 strike only near the expiry.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022