GBPAUD major trend has been bearish.

Short term bullish trend struggling for the momentum.

In the prevailing puzzled environment, you could observe that the momentary bulls of GBPAUD struggle to break and sustain above stiff resistance of 1.64 levels, currently trading in non-directly to signal some bearish pressures. We advocate below hedging strategy with cost effectiveness that could hedge regardless of the swings on either side.

Hedging Framework:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

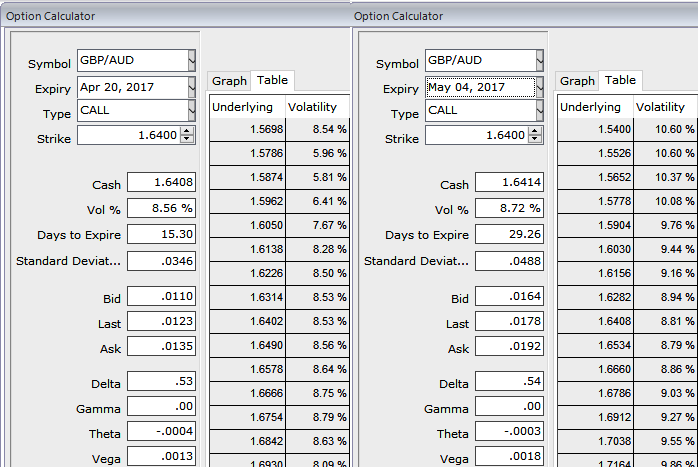

The execution: Initiate long in GBPAUD 1M at the money vega put, long 1M at the money vega call and simultaneously, Short theta in 2w (1%) out of the money call with positive theta or closer to zero. Theta is positive; time decay is bad for a buyer, but good for an option writer.

Rationale: As you could observe the vega of the long leg (buy) call option position is 113.51 USD and it implies that if IV increases or decreases by 1%, the option’s premium would have an impact in the increase or decrease by 113.51 USD, respectively. The Vega of a short (sell) option position is negative and an increasing IV is bad.

Please be noted that the 2w (1%) OTM calls are trading 39% more than NPV, while ATM implied volatility is trading at just shy above 8.5%, hence, amid struggling uptrend scenario we could see the disparity between IVs and pricing.

Hence, we encourage vega longs and short thetas in the non-directional trending pair but slightly favors bearish strategy as the vega signifies the sensitivity of an option’s value owing to a shift in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand