We’ve already stated that the major trend of USDJPY is stuck between 23.6% and 38.2% Fibonacci retracement levels from the last couple of months (refer monthly plotting), the trend on this timeframe shows failure swings exactly at 23.6% Fibonacci levels couple of times in the recent times. On the flip side, it has tested strong supports at or around 38.2% levels. In this oscillation, the pair is hovering on EMAs (refer monthly plotting).

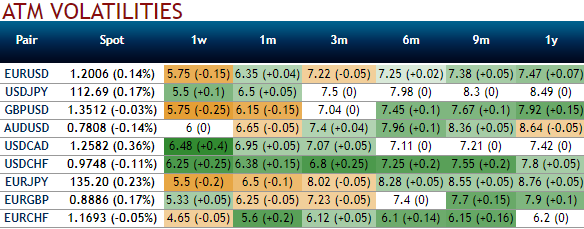

While please be noted that the shrinking IVs with bearish neutral risk reversals are in tandem with the spot and RR curves that are conducive to sell 1y IVs.

As long as the Japanese rates market is dormant due to the BoJ commitment to monetary easing, the currency will likely stay driven by the dollar leg. But we think that won’t be the case forever: at some point, the yen leg will come out of hibernation.

We could foresee only a small chance of that commitment waning in 2018 because the inflation rate won’t get anywhere near 2%, but the net result is a huge skew in the range of outcomes for the USDJPY.

Buy USDJPY 1y put spread strikes 106/103, global knock-in 116 Indicative offer: 0.33% (vanilla: 0.75%, spot ref: 112.676)

A USDJPY 1y put spread strikes 106/103 would cost 0.75%, thus providing a maximum payoff of 3.9 times the premium. Setting a global KI at 116 more than halves the price to provide leverage reaching 8.8 at 103 in one year.

Selling USDJPY 1y skew: In selling downside strikes, buy USDJPY puts is paying for the negative skew of low strikes. As we don’t foresee USDJPY crumpling below 100, needless to buy the total downside. Accordingly, we also finance our puts by selling the downside skew via put spreads.

In setting a topside knock-in, near-term, USDJPY should be initially mildly supported by mounting US yields. This suggests conditioning medium-term put spreads by a topside knock-in. Such a barrier will cheapen the vanilla trade, as the bearish skew discounts the market-implied probability of bullish moves.

Currency Strength Index: FxWirePro's hourly USD spot index has shown -119 (which is highly bearish), while hourly JPY spot index was at -48 (bearish) while articulating at 07:00 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts