We forecast AUD to decline to USD0.72 by 3Q’18. RBA commentary this year continues to reinforce Australia’s policy divergence with the G10, but the central bank now seems more comfortable with the level of AUD. We expect both monetary policy divergence and minimal support from commodity prices to push the currency lower over time.

Hence, we advocate shorts in Antipodeans through EURNZD and AUDJPY (put vs call spread). Stay short NZDUSD put.

The short Antipodean view has been motivated by multiple factors, all of which remain intact:

Our RBA outlook (on hold throughout 2018) is anchoring short-maturity interest rates and should keep 3yr swap rates in a 1.80% to 2.30% range, as long as core inflation remains below 2%.

The structural bearish view on both currencies on the expectation that unlike a lot of G10 central banks, the two RBA and RBNZ will remain on hold and

These currencies would be the most vulnerable in G10 given recent escalation in trade conflict.

A key development for these currencies in the past week has been China’s announcement of making its fiscal policy more active in 2H’18 which could improve the tone around commodity FX in general (via its implication for commodities and infrastructure spending), but our expectation is for such optimism to be limited given the downside tail risks to growth from a further escalation in trade conflict.

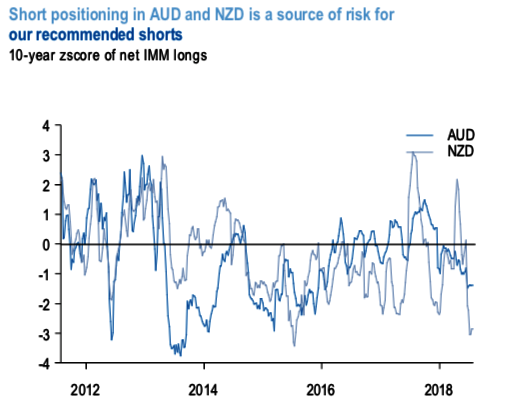

Nonetheless, that shorts in both AUD and NZD are outsized (refer above chart) are a cause for concern and thus continue to warrant monitoring of the mix in China's policy response in the coming weeks, making us tactical on these trades (a preference for fiscal/ infrastructure over monetary would be more supportive for Antipodean FX).

Near-term seasonals are on the margin are also supportive of our bearish view on high beta FX, as USD typically tends to strengthen in August vs. high beta FX (AUDUSD and NZDUSD on average have weakened by 1.4% and 2.3% in August over the past 5- years, respectively; refer 2nd chart).

Buy EURNZD at 1.7248, stop at 1.6720.

Long a 3m AUDJPY put, strike 77.50, short a 3m AUDJPY 81.25-83.50 call spread. Received 0.5bp.

Short NZDUSD through a covered put. Take profits on short cash from 0.6893 for +0.88%. Stay short a 2m 0.6677 NZDUSD put for 39.6bp. Marked at 9bp. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 72 levels (which is bullish), while hourly USD spot index was at 1 (absolutely neutral) while articulating (at 10:28 GMT). For more details on the index, please refer below weblink:

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes