Crude oil markets are growing nervous, days before OPEC is due to meet in Vienna on 30 November. Front-month prices on ICE Brent are currently retracing around $61.50, down $3 from the November highs and putting a pause to a four-month rally. Much of this week’s profit taking is the result of the market sifting through the data and separating the transitory noise from the underlying trend. In its latest monthly report, the IEA opined that the post-summer rally was more the result of temporary supply disruptions, citing lower-than-expected production from North America, supply interruptions in Iraq, geopolitical instability in the Middle East as well as “a growing expectation that the OPEC/non-OPEC output accord will be extended through 2018”. This week’s US petroleum report surprised the market with a 1.9m barrel stock built (vs -2.4 consensus). Moreover, questions already abound about Russia’s commitment to a renewed OPEC accord.

Crude prices surged today but en route for their first week of losses in six, as apprehensions grew over Russia's support for an extension of the crude output cuts that have bolstered prices in recent months. Brent was up about 50 cents at $61.86 a barrel by 10:00 GMT.

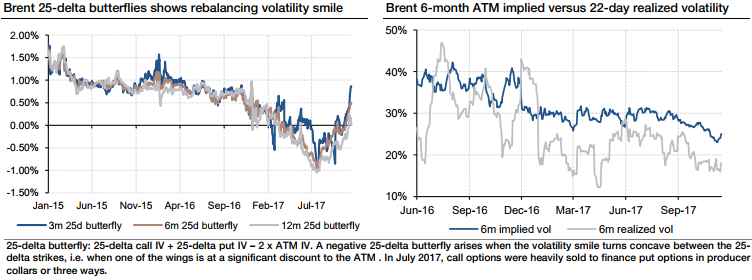

Regardless, sentiment has noticeably turned more constructive on the energy complex in the second half of the year, and in the options market as well. The shape of the volatility smile has seen the impact of relatively higher interest for call options. The bottom-left chart shows contant maturity 25-delta butterflies on short and long-dated Brent options. After bottoming out in July at -1%, these have again turned positive, suggesting the relative volatility premium of OTM put over OTM call options has eased.

Nevertheless, the market remains cautious. While higher prices have seen realized volatility fall consistently throughout the summer, implied volatility has however lagged, especially at longer maturities. At 25%, 6m at-the-money implied volatility is trading 7 percentage points above trailing 22-day realized volatility on Brent (see bottom-right chart). On WTI option too, the volatility premium has strengthened throughout the rally. Courtesy: SG

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential