The Norges Bank sounds ever more confident about economic prospects and keen to start the process of rate normalization seven years after the last hike. Just today Governor Olsen remarked on the solid prospects for investment and renewed optimism in the petroleum industry.

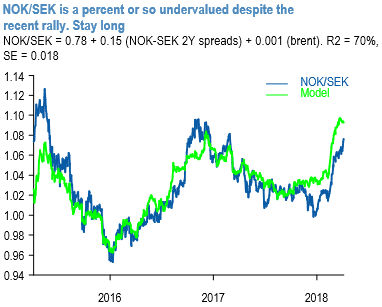

That the central bank is prepared to tighten without ever having resorted to emergency policy and with inflation running below the new lower inflation target (core is currently 1.4%) stands in stark contrast to Sweden where the central bank remains wedded to a pessimistic view of underlying inflation prospects and a neurosis about currency appreciation even though the currency is now 5% or so weaker than it projected as recently as February. The contrast in central bank attitudes leaves additional headroom for NOKSEK we believe, especially as the cross remains a percent or so below fair-value from a 3Y regression on rate spreads and oil (refer 1st chart).

In our view, the Norges Bank will start hiking in September and the pace will be in line with the roughly 50bp per annum that the Norges Bank set out in the March MPR. An August hike is a reasonable risk scenario.

By contrast, we believe that the Riksbank will hike no earlier than September and the market assumes there is a reasonable risk of the Riksbank downgrading its rate path at the April 26th MPR – Stina forwards are 15bp below the central bank’s path for 4Q’18 and25bp below the 4Q’19 level. There is some concern naturally that NOK is now a consensus and well positioned macro trade. We agree it is the consensus.

However, the Norges Bank's flow data does not yet point to an excessive accumulation of NOK exposure from foreign clients to the point where this might prevent as opposed to merely slowing further upside in NOK (refer 2nd chart). The dampening effect of the steady accumulation of foreign positions in NOK is consistent with the call spread we hold in NOKSEK (upside to 1.0920).

Trade tips: Stay long NOK via short EURNOK in the spot, long NOKSEK in options:

Short EURNOK spot at 9.4960 with the strict stop loss at 9.6675 levels.

Long a 3m NOKSEK 1.066/1.092 call spread vs short EURSEK 9.95 put for a net 20bp. Marked at 0.60%. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios