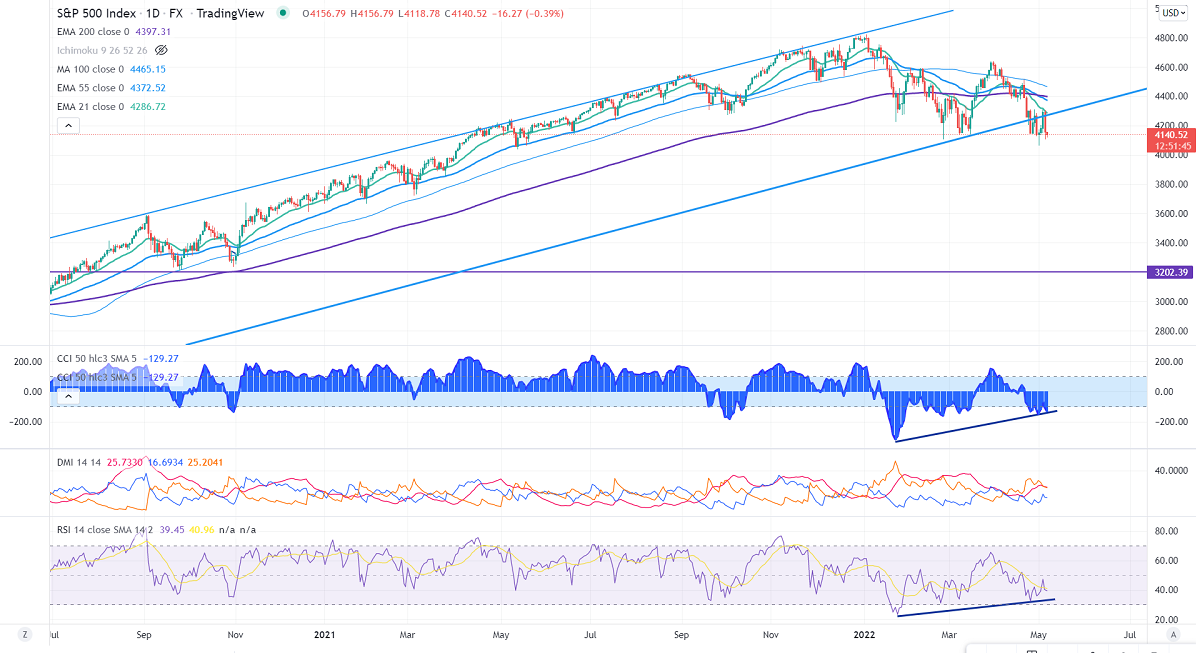

Major support- 4000

Chart pattern- Bullish divergence

S&P500 is trading lower for a fifth consecutive week on hawkish Fed hikes. Aggressive tightening measure by Fed has decreased demand for riskier assets. Markets eye US Non-farm payroll data for further movement. The index hits a low of 4062 and is currently trading around 4124.

The US 10-year yield surged sharply, hitting the highest level since 2018 has weighed on stock markets.

Technically, near-term resistance is at 4310 (double top) and any indicative break above targets 4405/4500/4635.

On the flip side, significant support stands at 4000 and violation below confirms major weakness, a dip till 3722/3600 likely.

It is good to buy on dips around 4100 with SL around 4000 for the TP of 4600.