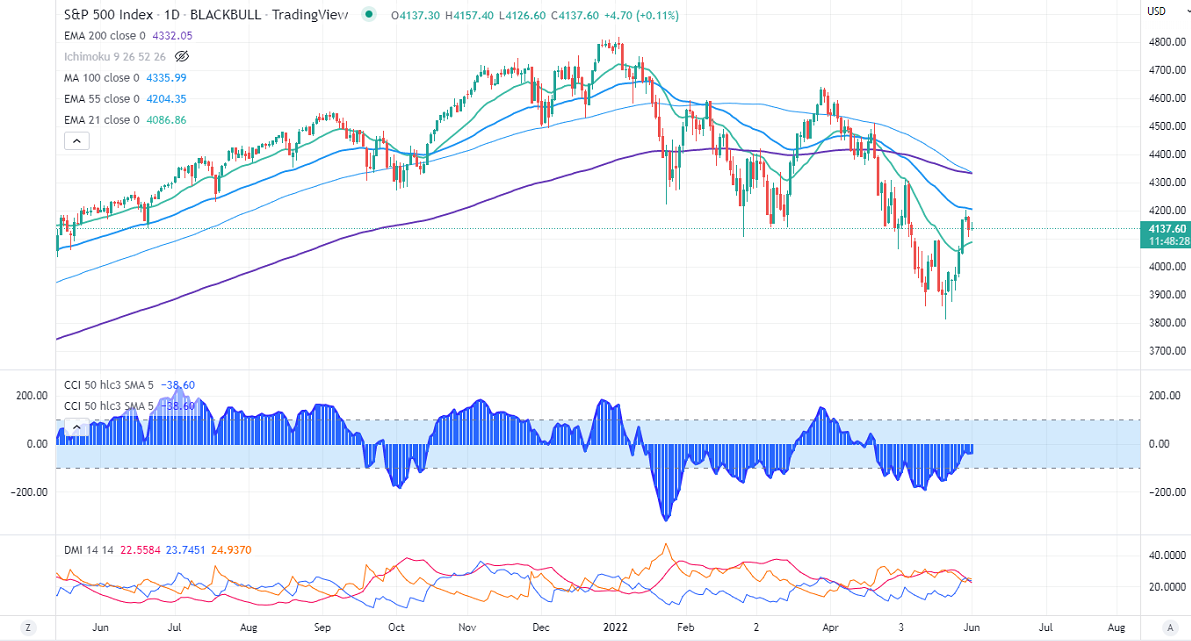

S&P500- The index formed a minor bottom around 3810 and showed a minor pullback of more than 400 points on upbeat market sentiment. US markets slumped sharply in May on weak earnings and rising inflation. A hawkish rate hike by Fed also puts pressure on global stock markets. According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in Jun jumped to 97.7% from 93.3% a week ago.

Markets eye US nonfarm payroll data this week for further direction.

The immediate resistance to be watched is 4210 (55-day EMA), any breach above will take to the next level 4250/4300. The near-term support is around 4080, and violation below that level targets 4050/4000/3800.

It is good to buy on dips around 4080 with SL around 4000 for TP of 4309.