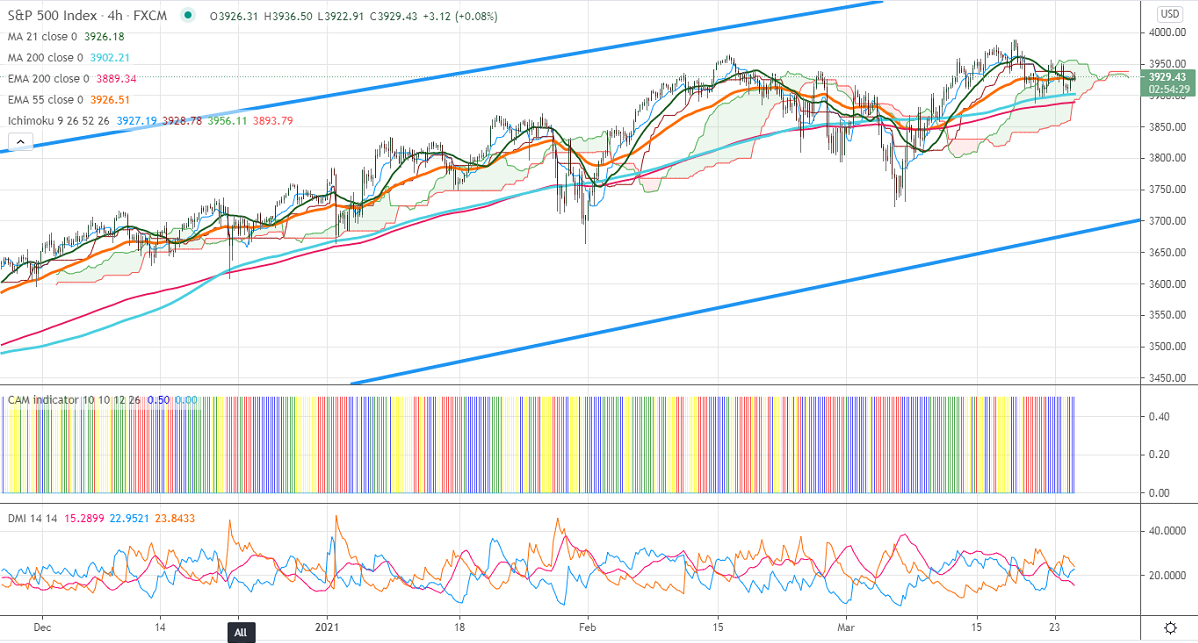

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 3927

Kijun-Sen-3935

S&P500 is consolidating after hitting a low of 3887.60 levels. The index halted its two weeks of bullishness on surge in coronavirus cases and extension of lockdown in Germany and the Netherlands. US markets under pressure for the past one week on tax hike fears. The slump in yield after hitting a multi-year high at 1.74% and holding below 1.65% level.

US durable goods orders declined by 1.1% in February compared to a forecast of 0.7%, the first time since Apr 2020. The flash manufacturing PMI came at 59 vs an estimate of 59.6. It hits an intraday high of 3936 and is currently trading around 3924. Markets eye Powell and Yellen testimony for further direction.

Technically, the index has taken support near 200-4H EMA (3888). Any violation below confirms that minor weakness, a dip till 3848/3800 is possible. On the higher side, the near-term significant resistance is around 3937 and any jump above will take the index to 3975/3987/4000.

It is good to sell on rallies around 3959-60 with SL around 3988 for TP of 3888/3850.