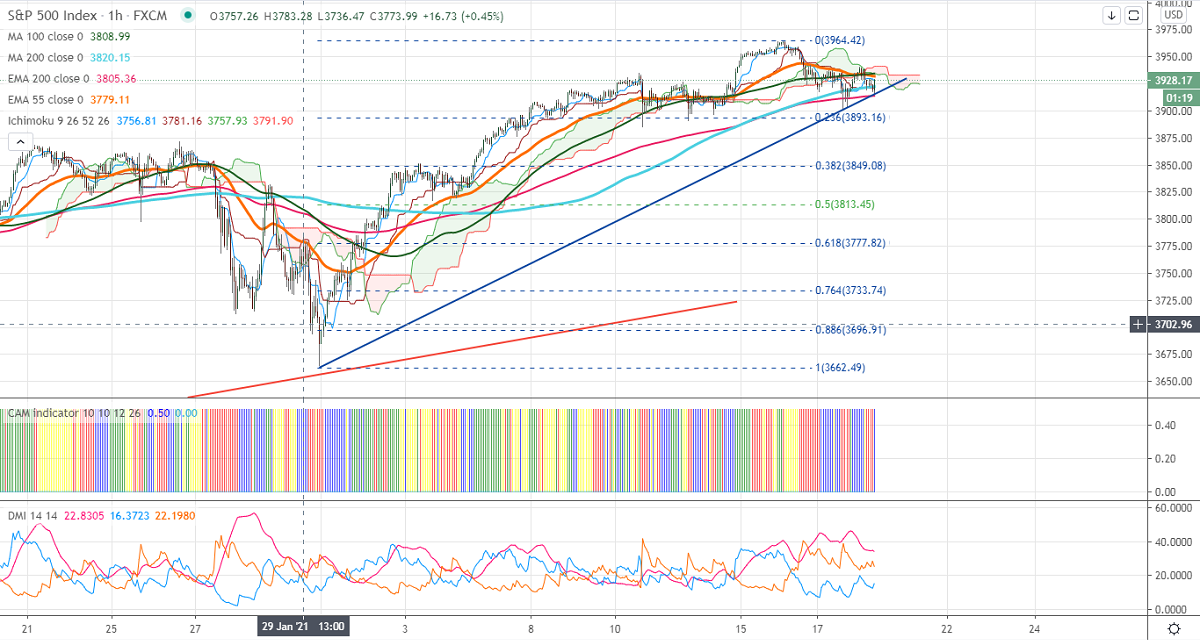

Ichimoku analysis (hourly chart)

Tenken-Sen- 3928

Kijun-Sen-3921

S&P500 was one of the best performers this month and surged more than 8% on upbeat market sentiment. The corona vaccine rollout, hopes of more U.S stimulus, and decline in COVID-19 cases have increase demand for risk appetite. US retail sales rose 5.3% in Jan m/m, the highest jump in the seventh months. The data came much better than the estimate of 1.1%. Market eye US initial jobless claims and Philly fed manufacturing index for further direction. The index hits a fresh all-time high of 3965 and is currently trading around 3927.

On the higher side, the near-term significant resistance is around 3940 and any jump above will take the index to 3965/4000.

The short-term support is at 3893 (23.6% fib), any violation below targets 3865/3820/3800.

It is good to sell on rallies around 3960-62 with SL around 4000 for TP of 3800.